22. Gymnastics4Life is a high-end facility for beginning, intermediate, and elite gymnasts. The latter are drawn from

Question:

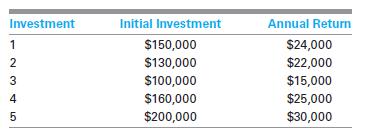

22. Gymnastics4Life is a high-end facility for beginning, intermediate, and elite gymnasts. The latter are drawn from the nearby region for exclusive and dedicated training. In order to maintain their edge, G4L trustees wish to invest up to

$350,000 in new methods for critical evaluation and training and are considering the following independent, divisible, investments, each of which guarantees return of the initial investment at the end of a planning horizon of 7 years. In addition, G4L will receive annual returns as noted below. MARR is 12%.

a. Determine the optimum portfolio, including which investments are fully or partially (if partial, give percentage) selected. You may use Excel®;

do not use SOLVER.

b. Determine the optimum portfolio and its PW, specifying which investments are fully or partially (give percentage) selected using (1) the current limit on investment capital, (2) plus 20%, and (3) minus 20%. Use Excel®

and SOLVER.

c. Determine the optimum portfolio and its PW, specifying which investments are fully or partially (give percentage) selected using (1) the current MARR, (2) plus 20%, and (3) minus 20%. Use Excel® and SOLVER.

d. Determine the optimum investment portfolio and its PW when investments 1 and 2 are divisible and investments 3, 4, and 5 are indivisible. Use Excel® and SOLVER.

Step by Step Answer:

Fundamentals Of Engineering Economic Analysis

ISBN: 9781118414705

1st Edition

Authors: John A. White, Kellie S. Grasman, Kenneth E. Case, Kim LaScola Needy, David B. Pratt