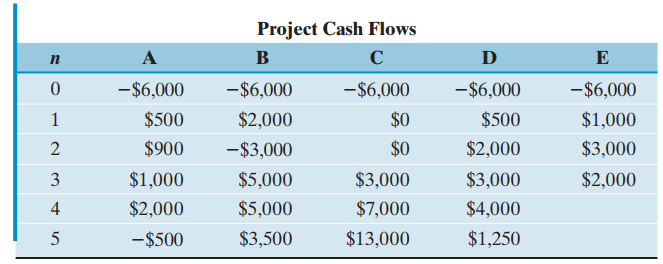

Consider the following sets of investment projects: (a) Compute the future worth at the end of life

Question:

(a) Compute the future worth at the end of life for each project at i = 15%.

(b) Determine the area of negative project balance for each project.

(c) Determine the discounted payback period for each project.

(d) Determine the area of positive project balance for each project.

Payback period method is a traditional method/ approach of capital budgeting. It is the simple and widely used quantitative method of Investment evaluation. Payback period is typically used to evaluate projects or investments before undergoing them,...

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: