Question:

Continuing Problem: Front Row Entertainment}

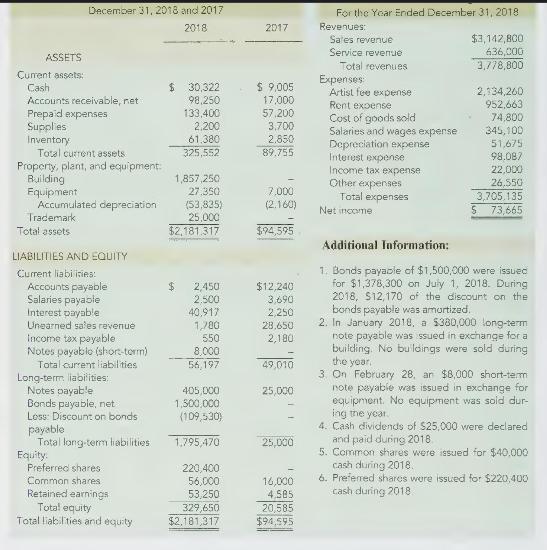

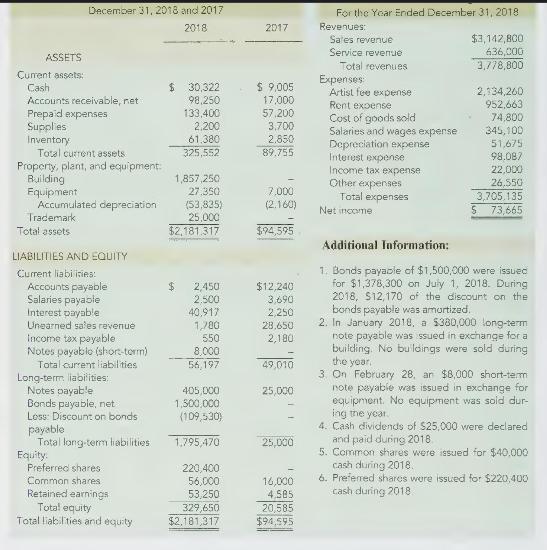

The statement of earnings and comparative statement of financial position for Front Row Entertainment are shown below:

\section*{Required:}

1. Prepare a statement of cash flows using the indirect method.

2. What conclusions can you draw about Front Row Entertainment from the observed pattern of cash flows?

\section*{Case

Transcribed Image Text:

December 31, 2018 and 2017 For the Year Ended December 31, 2018 2018 2017 Revenues: Sales revenue $3,142,800 Service revenue 636,000 ASSETS Total revenues 3,778,800 Current assets: Expenses Cash Accounts receivable, net $ 30,322 98,250 $ 9,005 Artist fee expense 2,134,260 17,000 Rent expense 952,663 Prepaid expenses 133,400 57.200 Cost of goods sold 74,800 Supplies 2,200 3.700 Salaries and wages expense 345,100 Inventory 61.380 2,850 Depreciation expense 51,675 Total current assets 325,552 89.755 Interest expense 98.087 Property, plant, and equipment: Income tax expense 22,000 Building 1,857,250 Other expenses 26,550 Equipment 27.350 7,000 Total expenses 3,705.135 Accumulated depreciation (53,835) (2.160) Net income 73,665 Trademark 25,000 Total assets $2,181,317 $94,595 LIABILITIES AND EQUITY 2,180 Additional Information: 1. Bonds payable of $1,500,000 were issued for $1,378,300 on July 1, 2018. During 2018, $12,170 of the discount on the bonds payable was amortized. 2. In January 2018, a $380,000 long-term note payable was issued in exchange for a building. No buildings were sold during the year. 3. On February 28, an $8,000 short-term note payable was issued in exchange for equipment. No equipment was sold dur- ing the year. 4. Cash dividends of $25,000 were declared and paid during 2018 5. Common shares were issued for $40,000 cash during 2018. 6. Preferred shares were issued for $220,400 cash during 2018 Current liabilities: Accounts payable $ 2,450 Salaries payable 2,500 Interest payable 40.917 Unearned sales revenue 1,780 $12,240 3,690 2,250 28.650 Income tax payable 550 Notes payable (short-term) 8,000 Total current liabilities 56,197 49,010 Long-term liabilities: Notes payable 405,000 25,000 Bonds payable, net 1,300,000 Less: Discount on bonds (109,530) payable Total long-term liabilities 1,795,470 25.000 Equity. Preferred shares 220,400 Common shares 56,000 Retained earnings 53,250 Total equity 329,650 16,000 4.585 20,585 Total liabilities and equity $2,181,317 $94,595