The Effect of Estimates of Life and Residual Value on Depreciation Expense} Summerside Manufacturing purchased a new

Question:

The Effect of Estimates of Life and Residual Value on Depreciation Expense}

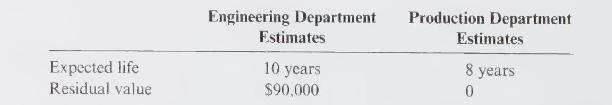

Summerside Manufacturing purchased a new computer-integrated system to manufacture a group of fabricated metal and plastic products. The equipment was purchased from Bessemer Systems at a cost of \(\$ 550,000\). As a basis for determining annual depreciation expense, Summerside's controller requests estimates of the expected life and residual value for the new equipment. The engineering and production departments submit the following divergent estimates:

Before considering depreciation expense for the new equipment, Summerside Manufacturing has net income in the amount of \(\$ 250,000\). Summerside uses the straight-line method of depreciation.

\section*{Required:}

1. Compute a full year's depreciation expense for the new equipment, using each of the two sets of estimates.

2. Ignoring income taxes, what will be the effect on net income of including a full year's depreciation expense based on the engineering estimates? Based on the production estimates?

3. If a business has a significant investment in depreciable assets, the expected life and residual value estimates can materially affect depreciation expense and therefore net income. What might motivate management to use the highest or lowest estimates?

\section*{Case

Step by Step Answer:

Cornerstones Of Financial Accounting

ISBN: 9780176707125

2nd Canadian Edition

Authors: Jay Rich, Jefferson Jones, Maryanne Mowen, Don Hansen, Donald Jones, Ralph Tassone