Continuing Problem: Front Row Entertainment} After a successful first year, Cam and Anna decide to expand Front

Question:

Continuing Problem: Front Row Entertainment}

After a successful first year, Cam and Anna decide to expand Front Row Entertainment's operations by becoming a venue operator as well as a tour promoter. A venue operator contracts with promoters to rent the venue (which can range from amphitheatres to indoor arenas to nightclubs) for specific events on specific dates. In addition to receiving revenue from renting the venue, venue operators also provide services such as concessions, parking, security, and ushering services. By vertically integrating their business, Cam and Anna can reduce the expense that they pay to rent venues. In addition, they will generate additional revenue by providing services to other tour promoters.

After a little investigation, Cam and Anna locate a small venue operator that owns Toronto Music House, a small indoor arena with a rich history in the music industry. The current owner has experienced severe health issues and has let the arena fall into a state of disrepair. However, he would like the arena to be preserved and its musical legacy to continue. After a short negotiation, on January 1, 2018, Front Row Entertainment purchased the venue by paying \(\$ 10,000\) in cash and signing a 15 -year \(10 \%\) note for \(\$ 390,000\). The land on which the arena sits is worth \(\$ 100,000\). In addition, Front Row Entertainment purchased the right to use the "Toronto Music House" name for \(\$ 25,000\).

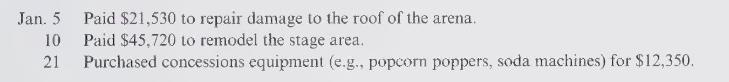

During the month of January 2018, Front Row Entertainment incurred the following expenditures as they renovated the arena and prepared it for the first major event scheduled for February:

Renovations were completed on January 28, and the first concert was held in the arena on February 1. The arena is expected to have a useful life of 30 years and a residual value of \(\$ 35,000\). The concessions equipment will have an estimated useful life of 5 years and a residual value of \(\$ 250\).

\section*{Required:}

1. Prepare the journal entries to record the acquisition of the arena, the concessions equipment, and the trademark.

2. Prepare the journal entries to record the expenditures made in January.

3. Compute and record the depreciation for 2018 (11 months) on the arena (use the straightline method) and on the concessions equipment (use the double-declining-balance method). Round all answers to the nearest dollar.

4. Would amortization expense be recorded for the trademark? Why or why not?

\section*{Case

Step by Step Answer:

Cornerstones Of Financial Accounting

ISBN: 9780176707125

2nd Canadian Edition

Authors: Jay Rich, Jefferson Jones, Maryanne Mowen, Don Hansen, Donald Jones, Ralph Tassone