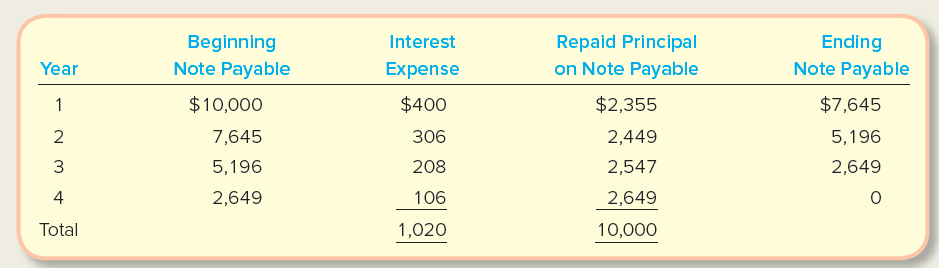

The following amortization schedule indicates the interest and principal to be repaid on an installment note established

Question:

The following amortization schedule indicates the interest and principal to be repaid on an installment note established January 1, 2018, for a company with a March 31 year-end.

Required:

1. Assuming the company makes the required annual payments on December 31, use the amortization schedule to determine (a) the amount of the (rounded) annual payment; (b) the amount of Interest Expense to report in the year ended March 31, 2018; (c) the amount of Interest Expense to report in the year ended March 31, 2019; (d) the Note Payable balance at January 1, 2021; and (e) the total interest and total principal paid over the note’s entire life.

2. Assuming the company makes adjustments at the end of each quarter, prepare the journal entries required on (a) January 1, 2018, and (b) March 31, 2018.

Step by Step Answer:

Fundamentals of Financial Accounting

ISBN: 978-1259864230

6th edition

Authors: Fred Phillips, Robert Libby, Patricia Libby