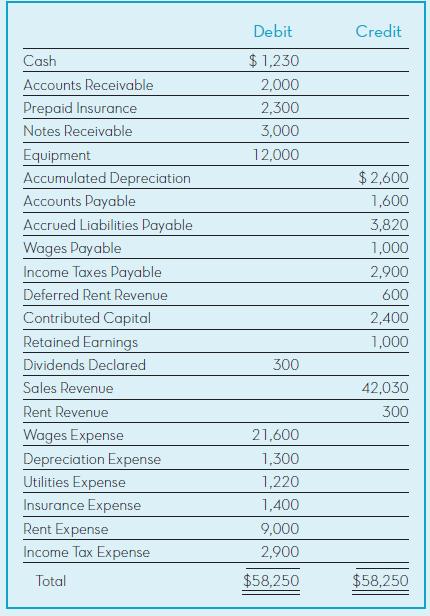

The SkyBlue Corporation has the following adjusted trial balance at December 31, 2017. Prepare an income statement

Question:

The SkyBlue Corporation has the following adjusted trial balance at December 31, 2017.

Prepare an income statement for the SkyBlue Corporation for the year ended December 31, 2017. How much net income did the company generate during 2017?

CorporationA Corporation is a legal form of business that is separate from its owner. In other words, a corporation is a business or organization formed by a group of people, and its right and liabilities separate from those of the individuals involved. It may...

Debit Credit Cash $ 1,230 Accounts Receivable 2,000 Prepaid Insurance 2,300 Notes Receivable 3,000 Equipment Accumulated Depreciation 12,000 $2,600 Accounts Payable 1,600 Accrued Liabilities Payable 3,820 Wages Payable 1,000 Income Taxes Payable 2,900 Deferred Rent Revenue 600 Contributed Capital 2,400 Retained Earnings 1,000 Dividends Declared 300 Sales Revenue 42,030 Rent Revenue 300 Wages Expense 21,600 Depreciation Expense 1,300 Utilities Expense 1,220 Insurance Expense 1,400 Rent Expense 9,000 Income Tax Expense 2,900 Total $58,250 $58,250

Step by Step Answer:

The SkyBlue Corporation generated 4910 of net income during 2017 SKYBLUE CORP...View the full answer

Fundamentals of Financial Accounting

ISBN: 978-1259269868

5th Canadian edition

Authors: Fred Phillips, Robert Libby, Patricia Libby, Brandy Mackintosh

Related Video

A trial balance is a list of all the general ledger accounts contained in the ledger of a business. This list will contain the name of each nominal ledger account and the value of that nominal ledger balance. Each nominal ledger account will hold either a debit balance or a credit balance

Students also viewed these Business questions

-

The Sky Blue Corporation has the following adjusted trial balance at December 31. Prepare an income statement for the year ended December 31. How much net income did the Sky Blue Corporation generate...

-

Prepare an income statement for a profitable small business. Include at least 10 operating expenses. Use an income tax rate of 25%.

-

Prepare an income statement for Patsys Posies, a merchandiser, for the year ended December 31, 2016 Part Two Patsys Posies was so successful that Patsy decided to manufacture her own brand of floral...

-

An experiment showed that subjects fed the DASH diet were able to lower their blood pressure by an average of 6.7 points compared to a group fed a "control diet." All meals were prepared by...

-

During a fast to lose weight, is it important to be physically active or might it be better to remain sedentary? Explain.

-

The Hardware Warehouse is evaluating the safety stock policy for all its items, as identified by the SKU code. For SKU M4389, the company always orders 80 units each time an order is placed. The...

-

Do you feel we need a global crisis (exceeding COVID-19), as humans, to seriously alter our course? What is the one condition that would make us pay attention during a global crisis?

-

Quality improvement, theory of constraints. The Wellesley Corporation makes printed cloth in two departments: weaving and printing. Currently, all product first moves through the weaving department...

-

When the indirect method of reporting cash flows from operating activities is used, payoff of a long-term liability with cash would be reported on the Statement of Cash Flows in the operating...

-

A gas mixture at 350 K and 300 kPa has the following volumetric analysis: 65 percent N2, 20 percent O2, and 15 percent CO2. Determine the mass fraction and partial pressure of each gas.

-

On December 31, 2017, J. Alan and Company prepared an income statement and balance sheet but failed to take into account four adjusting journal entries. The income statement, prepared on this...

-

Refer to E4-8. Data From E4-8. Nicklebys Ski Store is completing the accounting process for its first year ended December 31, 2017. The transactions during 2017 have been journalized and posted. The...

-

Compute the dividend yield for each of these four separate companies. Which companys stock would probably not be classified as an income stock? 1 2 Company 1 2 34 a w b Sheet Shelve@] B Annual Cash...

-

We find a binary system consisting of a 1 solar mass star, still in its main sequence phase, and a white dwarf. Assume both stars formed at the same time and that they did not significantly influence...

-

The equity sections from Atticus Group's 2015 and 2016 year-end balance sheets follow. Stockholders Equity (December 31, 2015) Common stock $6 par value, 50,000 shares authorized, 35,000 shares...

-

Molina Company produces three products: A130, B324, and C587 All three products use the same direct material, Brac Unt data for the three products are in the provided table. (Click to view the unit...

-

MFGE 437 S21 - Homework 1 Submissions will be Online! Please scan your HWs and upload on Canvas Problem 1: A vertical milling machine is to be retrofitted with three identical DC servo motors. The...

-

On January 1, Palisades, Inc., acquired 100 percent of Sherwood Company's common stock for a fair value of $120,340,000 in cash and stock. The carrying amounts of Sherwood's assets and liabilities...

-

a. A gambler knows that red and black are equally likely to occur on each spin of a roulette wheel. He observes that 5 consecutive reds have occurred and bets heavily on black at the next spin. Asked...

-

Find the equation of the plane passing through the points P 5,4,3 ,Q 4,3,1 and R 1,5,4

-

On January 1, 2014, when the market interest rate was 9 percent, Selton Corporation completed a $200,000, 8 percent bond issue for $187,163. The bonds were dated January 1, 2014, pay interest each...

-

Refer to the information in E10-14 and assume Selton Corporation uses the effective-interest method to amortize the bond discount. Refer to E10-14, On January 1, 2014, when the market interest rate...

-

Refer to the information in E10-14 and assume Selton Corporation accounts for the bond using the simplified effective-interest method shown in Supplement 10C. Refer to E10-14, On January 1, 2014,...

-

true- false statement (c) Cost-based accounting is conservative

-

C. Inventory Revaluation Outdoor Recreation has the following three trailers in stock at the end of the year: Model #1103 #1204 #1305 Original cost 5,500 7,200 9,000 Expected sales price 5,700 8,500...

-

true- false statement (8) Unanimity implies that shareholders have no incentive to use their voting rights. (1) With corporate income tax, retention dominates dividends

Study smarter with the SolutionInn App