On December 31, 2017, J. Alan and Company prepared an income statement and balance sheet but failed

Question:

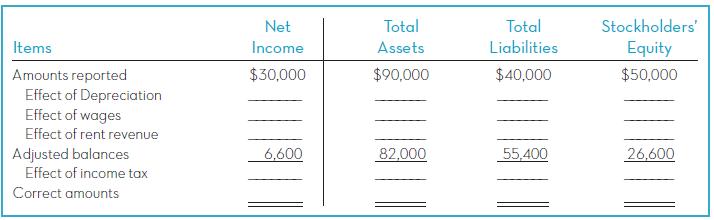

On December 31, 2017, J. Alan and Company prepared an income statement and balance sheet but failed to take into account four adjusting journal entries. The income statement, prepared on this incorrect basis, reported income before income tax of $30,000. The balance sheet (before the effect of income taxes) reflected total assets of $90,000, total liabilities of $40,00, and shareholders’ equity of $50,000. The data for the four adjusting journal entries follow:

a. Depreciation of $8,000 for the year on equipment was not recorded.

b. Wages amounting to $17,000 for the last three days of December 2017 were not paid and not recorded (the next payroll will be on January 10, 2018).

c. Rent revenue of $4,800 was collected on December 1, 2017, for office space for the threemonth period December 1, 2017, to February 28, 2018. The $4,800 was credited in full to Deferred Rent Revenue when collected.

d. Income taxes were not recorded. The income tax rate for the company is 30 percent.

Required:

Complete the following table to show the effects of the four adjusting journal entries (indicate deductions with parentheses):

Balance sheet is a statement of the financial position of a business that list all the assets, liabilities, and owner’s equity and shareholder’s equity at a particular point of time. A balance sheet is also called as a “statement of financial...

Step by Step Answer:

Fundamentals of Financial Accounting

ISBN: 978-1259269868

5th Canadian edition

Authors: Fred Phillips, Robert Libby, Patricia Libby, Brandy Mackintosh