Assume that the tracking error of portfolio X in Problem 3 is 9.2 percent. What is the

Question:

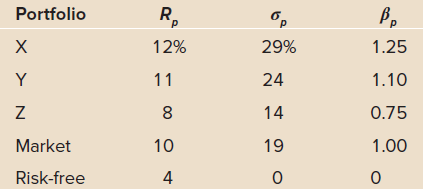

Data From Problem 3

You are given the following information concerning three portfolios, the market portfolio, and the risk-free asset: What are the Sharpe ratio, Treynor ratio, and Jensen€™s alpha for each portfolio?

What are the Sharpe ratio, Treynor ratio, and Jensen€™s alpha for each portfolio?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Fundamentals of Investments, Valuation and Management

ISBN: 978-1259720697

8th edition

Authors: Bradford Jordan, Thomas Miller, Steve Dolvin

Question Posted: