Mr. Wallace asks the trainees which of the following explains an upward-sloping yield curve according to the

Question:

a. The market expects short-term rates to rise through the relevant future.

b. There is greater demand for short-term securities than for long-term securities.

c. There is a risk premium associated with more distant maturities.

James Wallace, CFA, is a fixed-income fund manager at a large investment firm. Each year the firm recruits a group of new college graduates. Recently, Mr. Wallace was asked to teach the fixed-income portion of the firm€™s training program. Mr. Wallace wants to start by teaching the various theories of the term structure of interest rates and the implications of each theory for the shape of the Treasury yield curve. To evaluate the trainees€™ understanding of the subject, he creates a series of questions.

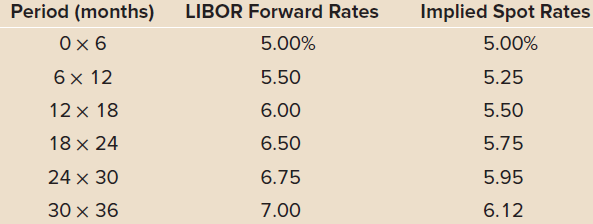

The following interest rate scenario is used to derive examples on the different theories used to explain the shape of the term structure and for all computational problems in Mr. Wallace€™s lecture. He assumes a rounded day count of 0.5 year for each semiannual period.

To read the period column, let€™s look at the 12 × 18 line. The €œ12€ stands for 12 months from now and the €œ18€ stands for 18 months from now. So, the 12 × 18 forward rate is a six-month rate that begins 12 months from now.

Step by Step Answer:

Fundamentals of Investments, Valuation and Management

ISBN: 978-1259720697

8th edition

Authors: Bradford Jordan, Thomas Miller, Steve Dolvin