Question:

Cofield Engineering uses the allowance method of recording uncollectible accounts expense.

Instructions:

Journalize the following transactions completed during the current year. Use page 4 of a general journal and page 10 of a cash receipts journal. Source documents are abbreviated as follows: memorandum, M; receipt, R.

Transcribed Image Text:

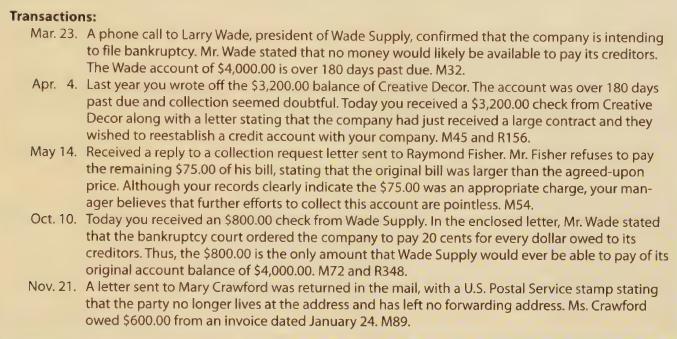

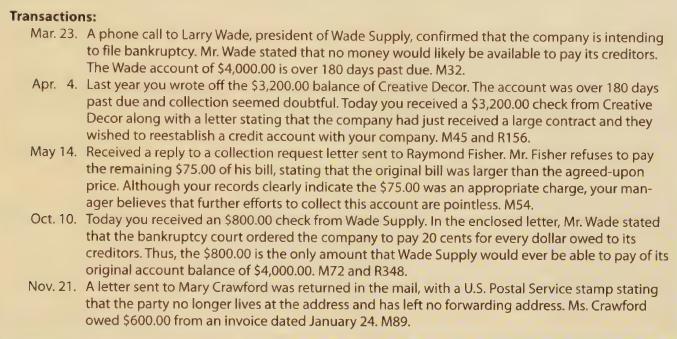

Transactions: Mar. 23. A phone call to Larry Wade, president of Wade Supply, confirmed that the company is intending to file bankruptcy. Mr. Wade stated that no money would likely be available to pay its creditors. The Wade account of $4,000.00 is over 180 days past due. M32. Apr. 4. Last year you wrote off the $3,200.00 balance of Creative Decor. The account was over 180 days past due and collection seemed doubtful. Today you received a $3,200.00 check from Creative Decor along with a letter stating that the company had just received a large contract and they wished to reestablish a credit account with your company. M45 and R156. May 14. Received a reply to a collection request letter sent to Raymond Fisher. Mr. Fisher refuses to pay the remaining $75.00 of his bill, stating that the original bill was larger than the agreed-upon price. Although your records clearly indicate the $75.00 was an appropriate charge, your man- ager believes that further efforts to collect this account are pointless. M54. Oct. 10. Today you received an $800.00 check from Wade Supply. In the enclosed letter, Mr. Wade stated that the bankruptcy court ordered the company to pay 20 cents for every dollar owed to its creditors. Thus, the $800.00 is the only amount that Wade Supply would ever be able to pay of its original account balance of $4,000.00. M72 and R348. Nov. 21. A letter sent to Mary Crawford was returned in the mail, with a U.S. Postal Service stamp stating that the party no longer lives at the address and has left no forwarding address. Ms. Crawford owed $600.00 from an invoice dated January 24. M89.