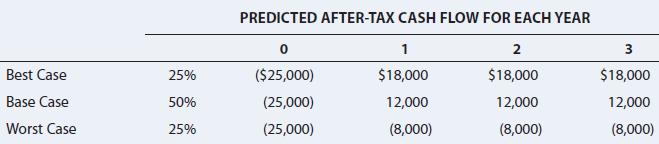

firm is considering a project with the following after-tax cash flows: You learn that the firm can

Question:

firm is considering a project with the following after-tax cash flows:

You learn that the firm can abandon the project, if it so chooses, after 1 year of operation, in which case it can sell the asset and receive $15,000 after taxes in cash at the end of Year 2.

The WACC is 12%.

a. What is the project’s expected NPV without the abandonment option?

b. What is the expected NPV with the abandonment option?

c. What is the value of the abandonment option?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Fundamentals Of Financial Management

ISBN: 9780357517574

16th Edition

Authors: Eugene F. Brigham, Joel F. Houston

Question Posted: