Harmon Corporation has four potential projects: M, N, O, and P. Projects O and P are mutually

Question:

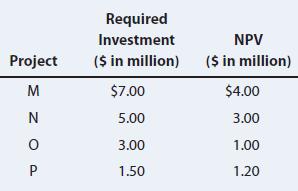

Harmon Corporation has four potential projects: M, N, O, and P.

Projects O and P are mutually exclusive. The table provides the required investment and NPV for each project.

Using the information in the table, answer the following questions.

a. Make a table of all the possible capital budgeting strategies based on the combination of the four available projects. Remember that Projects O and P are mutually exclusive. Be sure to include the required investment and NPV of each strategy in the table.

b. If the firm is not capital constrained, which projects would be selected, what would be the optimal capital budget, and what would be the NPV for that optimal capital budget?

c. Suppose that the firm is now capital constrained and only has $12 million of available capital. Which projects would be selected, what would be the optimal capital budget subject to the capital constraint, and what would be the NPV for that capital budget?

d. Because of the capital constraint, how much value does the firm lose between the NPVs of the selected projects in parts b and c?

Step by Step Answer:

Fundamentals Of Financial Management

ISBN: 9780357517574

16th Edition

Authors: Eugene F. Brigham, Joel F. Houston