Lancaster Engineering Inc. (LEI) has the following capital structure, which it considers to be optimal: LEIs expected

Question:

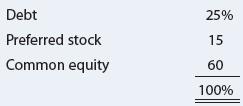

Lancaster Engineering Inc. (LEI) has the following capital structure, which it considers to be optimal:

LEI’s expected net income this year is $34,285.72, its established dividend payout ratio is 30%, its federal-plus-state tax rate is 25%, and investors expect future earnings and dividends to grow at a constant rate of 9%. LEI paid a dividend of $3.60 per share last year, and its stock currently sells for $54.00 per share. LEI can obtain new capital in the following ways: (1) New preferred stock with a dividend of $11.00 can be sold to the public at a price of $95.00 per share. (2) Debt can be sold at an interest rate of 12%.

a. Determine the cost of each capital component.

b. Calculate the WACC.

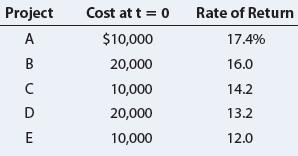

c. LEI has the following investment opportunities that are average-risk projects:

Which projects should LEI accept? Why? Assume that LEI does not want to issue any new common stock.

Step by Step Answer:

Fundamentals Of Financial Management

ISBN: 9780357517574

16th Edition

Authors: Eugene F. Brigham, Joel F. Houston