Jamie Wong is thinking of building an investment portfolio containing two stocks, L and M. Stock L

Question:

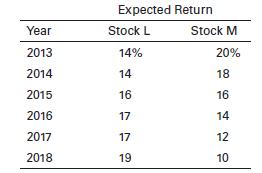

Jamie Wong is thinking of building an investment portfolio containing two stocks, L and M. Stock L will represent 40% of the dollar value of the portfolio, and stock M will account for the other 60%. The historical returns over the last 6 years, 2013– 2018, for each of these stocks are shown in the following table.

a. Calculate the actual portfolio return, rp, for each of the 6 years.

b. Calculate the average return for each stock and for the portfolio over the 6-year period.

c. Calculate the standard deviation of returns for each asset and for the portfolio. How does the portfolio standard deviation compare to the standard deviations of the individual assets?

d. How would you characterize the correlation of returns of the two stocks L and M?

e. Discuss any benefits of diversification achieved by Jamie through creation of the portfolio.

Step by Step Answer:

Fundamentals Of Investing

ISBN: 9780135175217

14th Edition

Authors: Scott B. Smart, Lawrence J. Gitman, Michael D. Joehnk