EXERCISE 11.1 (Caplets and options on zero-coupon bonds) Assume that the lognormal LIBOR market model holds. Use

Question:

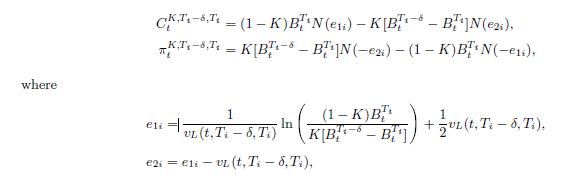

EXERCISE 11.1 (Caplets and options on zero-coupon bonds) Assume that the lognormal LIBOR market model holds. Use the caplet formula (11.19) and the relations between caplets, floorlets, and European bond options known from Chapter 6 to show that the following pricing formulas for European options on zero-coupon bonds are valid:

and vL(t, Ti −, Ti) is given by (11.22) in the one-factor setting and by (11.26) in the multi-factor setting.

Note that these pricing formulas only apply to options expiring at one of the time points T0, T1, . . . , Tn−1, and where the underlying zero-coupon bond matures at the following date in this sequence. In other words, the time distance between the maturity of the option and the maturity of the underlying zero-coupon bond must be equal to .

Step by Step Answer:

Fixed Income Analysis Securities Pricing And Risk Management

ISBN: 218144

1st Edition

Authors: Claus Munk