(The Hull-White model calibrated to the Vasicek yield curve) Suppose the observable bond prices are fitted to...

Question:

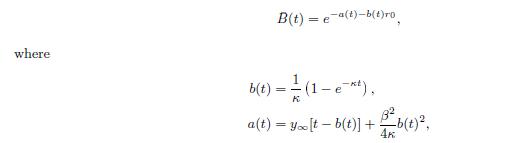

(The Hull-White model calibrated to the Vasicek yield curve) Suppose the observable bond prices are fitted to a discount function of the form

where y∞, , and are constants. This is the discount function of the Vasicek model, cf. (7.56)–(7.58) on page 167.

(a) Express the initial forward rates ¯ f(t) and the derivatives ¯ f′(t) in terms of the functions a and b.

(b) Show by substitution into (9.22) that the function ˆ(t) in the Hull-White model will be given by the constant

![]()

when the initial “observable” discount function is of the form (*), i.e. as in the Vasicek model.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Fixed Income Analysis Securities Pricing And Risk Management

ISBN: 218144

1st Edition

Authors: Claus Munk

Question Posted: