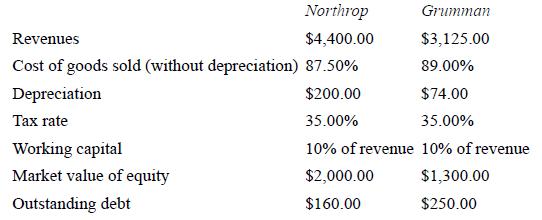

The following are the details of two potential merger candidates, Northrop and Grumman, in 1993: Both firms

Question:

The following are the details of two potential merger candidates, Northrop and Grumman, in 1993:

Both firms are are expected to grow 5% a year in perpetuity. Capital spending is expected to be 20% of depreciation. The beta for both firms is 1, and both firms are rated BBB, with an interest rate on their debt of 8.5% (The Treasury bond rate is 7%, and the risk premium is 5.5%.)

As a result of the merger, the combined firm is expected to have a cost of goods sold of only 86% of total revenues. The combined firm does not plan to borrow additional debt.

a. Estimate the value of Grumman, operating independently.

b. Estimate the value of Northrop, operating independently.

c. Estimate the value of the combined firm, with no synergy.

d. Estimate the value of the combined firm, with synergy.

e. How much is the operating synergy worth?

Step by Step Answer:

Investment Valuation Tools And Techniques For Determining The Value Of Any Asset

ISBN: 9781118011522

3rd Edition

Authors: Aswath Damodaran