170 Deferred tax allowance study. A study was conducted to identify accounting choice variables that influence a

Question:

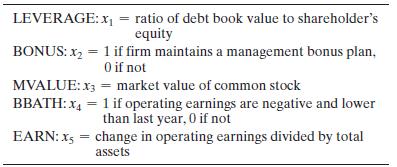

170 Deferred tax allowance study. A study was conducted to identify accounting choice variables that influence a manager’s decision to change the level of the deferred tax asset allowance at a firm ( The Engineering Economist , Jan./Feb. 2004). Data were collected on a sample of 329 firms that reported deferred tax assets.

The dependent variable of interest (DTVA) is measured as the change in the deferred tax asset valuation allowance divided by the deferred tax asset. The independent variables used as predictors of DTVA are as follows:

A first-order model was fitted to the data with the following results ( p -values are in parantheses):

![]()

a. Interpret the estimate of the b -coefficient for x4.

b. The “Big Bath” theory proposed by the researchers states that the mean DTVA for firms with negative earnings and earnings lower than last year will exceed the mean DTVA of other firms. Is there evidence to support this theory? Test, using a = .05.

c. Interpret the value of Ra 2 .

Step by Step Answer: