Jeff has incurred substantial losses in his sole proprietorship as a travel agent. He recently filed for

Question:

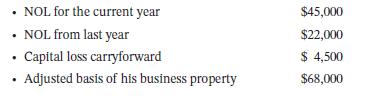

Jeff has incurred substantial losses in his sole proprietorship as a travel agent. He recently filed for bankruptcy. As part of the bankruptcy process, $100,000 of Jeff’s debt is forgiven. Jeff has the following tax attributes:

a. What are the tax consequences of the forgiven debt?

b. Assume the same facts as in part a except that Jeff makes an election to reduce the basis of depreciable property before the reduction of the other tax attributes. How does this change the result?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Fundamentals Of Taxation For Individuals A Practical Approach 2024

ISBN: 9781119744191

1st Edition

Authors: Gregory A Carnes, Suzanne Youngberg

Question Posted: