(a) Company X has been offered the swap quotes in Table 7.3. It can invest for four...

Question:

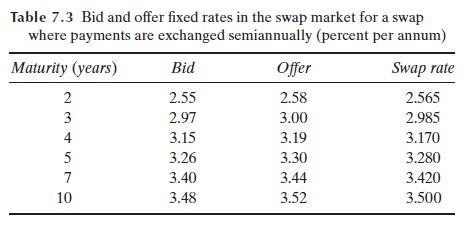

(a) Company X has been offered the swap quotes in Table 7.3. It can invest for four years at 2.8%. What floating rate can it swap this fixed rate into?

(b) Company Y has also been offered the swap quotes in Table 7.3. It is confident that it will be able to invest at LIBOR minus 50 basis points for the next ten years. What fixed rate can it swap this floating rate into?

Data from Table 7.3.

Transcribed Image Text:

Table 7.3 Bid and offer fixed rates in the swap market for a swap where payments are exchanged semiannually (percent per annum) Maturity (years) Bid Swap rate 2.55 2.565 2.97 2.985 3.15 3.170 3.26 3.40 3.48 2 3 4 5 7 10 Offer 2.58 3.00 3.19 3.30 3.44 3.52 3.280 3.420 3.500

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 66% (3 reviews)

Answered By

Muhammad Ahtsham Shabbir

I am a professional freelance writer with more than 7 years’ experience in academic writing. I have a Bachelor`s Degree in Commerce and Master's Degree in Computer Science. I can provide my services in various subjects.

I have professional excellent skills in Microsoft ® Office packages such as Microsoft ® Word, Microsoft ® Excel, and Microsoft ® PowerPoint. Moreover, I have excellent research skills and outstanding analytical and critical thinking skills; a combination that I apply in every paper I handle.

I am conversant with the various citation styles, among them; APA, MLA, Chicago, Havard, and AMA. I also strive to deliver the best to my clients and in a timely manner.My work is always 100% original. I honestly understand the concern of plagiarism and its consequences. As such, I ensure that I check the assignment for any plagiarism before submission.

4.80+

392+ Reviews

587+ Question Solved

Related Book For

Fundamentals Of Futures And Options Markets

ISBN: 9781292422114

9th Global Edition

Authors: John Hull

Question Posted:

Students also viewed these Business questions

-

(a) Company A has been offered the swap quotes in Table 7.3. It can borrow for three years at 3.45%. What floating rate can it swap this fixed rate into? (b) Company B has also been offered the swap...

-

(a) Company X has been offered the rates shown in Table 7.3. It can invest for four years at 5.5%. What floating rate can it swap this fixed rate into? (b) Company Y has been offered the rates shown...

-

References: Health Information Management Case Studies Second Edition AHIMA by Dianna M. Foley Health Information Management Technology an Applied Approah Sixth Edition AHIMA by Nanette Sayles and...

-

Suppose that in a particular area the consumption of water varies tremendously throughout the year, with average household summer use exceeding winter use by a great deal. What effect would this have...

-

You are part of a team that is evaluating and selecting an outsourcing service provider for your firm. During the course of your initial conversation with a manager from one prospective vendor, she...

-

Rewrite the ideal gas law so that the molar mass (MM) of a gas is equal to the other variables in the ideal gas law equation.

-

For each of the following separate cases, recommend a form of business organization. With each recommendation, explain how business income would be taxed if the owners adopt the form of organization...

-

Hill Propane Distributors wants to construct a pro forma balance sheet for 2013. Build the statement using the following data and assumptions: 1. Projected sales for 2013 are $35 million. 2. Hills...

-

Beginning inventory, purchases, and sales for Item 4417 are as follows: July 1 Inventory 50 units $80 12 Sale 30 units 19 Purchase 40 units $85 28 Sale 25 units Assuming a perpetual inventory system...

-

Your firm represents Amanda and Sam Baker, grandparents of two year old Brian Baker. Brian was recently injured in a home accident. The two year old stuck a hairpin into an electrical outlet and was...

-

In an interest rate swap, a financial institution has agreed to pay 3.6% per annum and to receive three-month LIBOR in return on a notional principal of $100 million with payments being exchanged...

-

Why is the expected loss to a bank from a default on a swap with a counterparty less than the expected loss from the default on a loan to the counterparty when the loan and swap have the same...

-

Determining How Variances Are Computed Helon Company uses a standard cost system in its accounting for the manufacturing costs of its only product. The standard cost information for materials and...

-

Childhood leukemia, a hematological malignancy, is the most common form of childhood cancer, representing 29% of cancers in children aged 0 to 14 years in 2018. Imagine that you work in the State...

-

Question 1 Approximating functions using linear functions or higher degree polynomials is a very useful scientific tool! This concept generalizes to Taylor Polynomials, but is most simply illustrated...

-

Find the volume of the solid of revolution formed by rotating the specified region R about the x axis. Volume Formula Suppose f(x) is continuous and f(x) 0 on a x b, and let R be the region under the...

-

As machines get older, the cost of maintaining them tends to increase. Suppose for a particular machine, the rate at which the maintenance cost is increasing is approximated by the function C' (t) =...

-

At Edsel Automotive, the management team is planning to expand one of its plants by adding a new assembly line for sport utility vehicles (SUVs). The cost of setting up the new SUV assembly line is...

-

Assume an economy in which the marginal propensity to consume, c, is 0.8, the income tax rate, t, is 0.2, and the share of imports in GDP, nx, is 0.04. Autonomous consumption, Ca, is 660; autonomous...

-

Write the given system without the use of matrices. D) - ()- d (x sin t + 8 (2+ 1)

-

A three-year convertible bond with a face value of $100 has been issued by company ABC. It pays a coupon of $5 at the end of each year. It can be converted into ABC's equity at the end of the first...

-

Show that, if there is no recovery from the bond in the event of a default, a convertible bond can be valued by assuming that (a) both the expected return and discount rate are r + and (b) there is...

-

Show that, if there is no recovery from the bond in the event of a default, a convertible bond can be valued by assuming that (a) both the expected return and discount rate are r + and (b) there is...

-

What is the present value of $500 invested each year for 10 years at a rate of 5%?

-

GL1203 - Based on Problem 12-6A Golden Company LO P2, P3 Golden Corp.'s current year income statement, comparative balance sheets, and additional information follow. For the year, (1) all sales are...

-

A project with an initial cost of $27,950 is expected to generate cash flows of $6,800, $8,900, $9,200, $8,100, and $7,600 over each of the next five years, respectively. What is the project's...

Study smarter with the SolutionInn App