(a) Company A has been offered the swap quotes in Table 7.3. It can borrow for three...

Question:

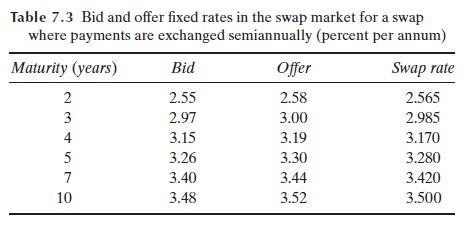

(a) Company A has been offered the swap quotes in Table 7.3. It can borrow for three years at 3.45%. What floating rate can it swap this fixed rate into?

(b) Company B has also been offered the swap quotes in Table 7.3. It can borrow for five years at LIBOR plus 75 basis points. What fixed rate can it swap this rate into?

(c) Explain the rollover risks that Company B is taking.

Data from Table 7.3.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Fundamentals Of Futures And Options Markets

ISBN: 9781292422114

9th Global Edition

Authors: John Hull

Question Posted: