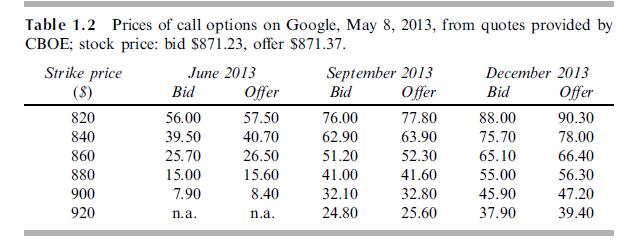

On May 8, 2013, as indicated in Table 1.2, the spot offer price of Google stock is

Question:

On May 8, 2013, as indicated in Table 1.2, the spot offer price of Google stock is \(\$ 871.37\) and the offer price of a call option with a strike price of \(\$ 880\) and a maturity date of September is \(\$ 41.60\). A trader is considering two alternatives: buy 100 shares of the stock and buy 100 September call options. For each alternative, what is

(a) the upfront cost,

(b) the total gain if the stock price in September is \(\$ 950\), and

(c) the total loss if the stock price in September is \(\$ 800\). Assume that the option is not exercised before September and if the stock is purchased it is sold in September.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: