Showbiz Video completed the following payroll transactions during the first two weeks of December. Showbiz Video pays

Question:

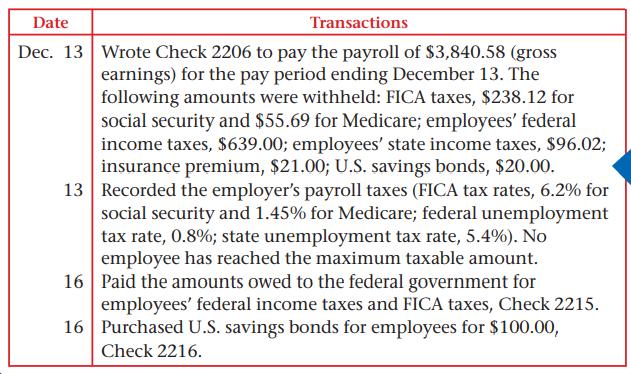

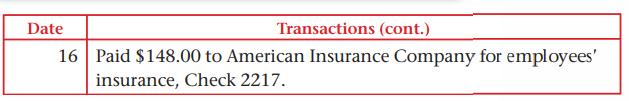

Showbiz Video completed the following payroll transactions during the first two weeks of December. Showbiz Video pays its employees on a biweekly basis (every two weeks).

Instructions

In your working papers:

1. Record the December 13 transactions on page 38 in the general journal.

2. Post both payroll entries to the appropriate general ledger accounts.

3. Journalize and post the December 16 transactions.

Transcribed Image Text:

Date Transactions Dec. 13 Wrote Check 2206 to pay the payroll of $3,840.58 (gross earnings) for the pay period ending December 13. The following amounts were withheld: FICA taxes, $238.12 for social security and $55.69 for Medicare; employees' federal income taxes, $639.00; employees' state income taxes, $96.02; insurance premium, $21.00; U.S. savings bonds, $20.00. 13 Recorded the employer's payroll taxes (FICA tax rates, 6.2% for social security and 1.45% for Medicare; federal unemployment tax rate, 0.8%; state unemployment tax rate, 5.4%). No employee has reached the maximum taxable amount. Paid the amounts owed to the federal government for employees' federal income taxes and FICA taxes, Check 2215. 16 Purchased U.S. savings bonds for employees for $100.00, 16 Check 2216.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 75% (12 reviews)

1 General Journal Date Description Debit Credit 1312 Wages Payable 38405...View the full answer

Answered By

Hande Dereli

Enthusiastic tutor, skilled in ACT and SAT tutoring. Raised one student's score on the SATs from 1100 combined to 1400. Graduated with a 3.9 GPA from Davidson College and led a popular peer tutoring group for three years. Scored in the top 0.06% in the nation on the SATs. The real reason I'm the one to help you nail the test? Results. Clients invariably praise my ability to listen and communicate in a low-stress, fun way. I think it's that great interaction that lets me raise retest SAT scores an average of 300 points.

0.00

0 Reviews

10+ Question Solved

Related Book For

Question Posted:

Students also viewed these Business questions

-

Schroeder Company pays its employees on a biweekly basis This means that each pay period is two weeks long Therefore there are 26 pay periods each year Assume the following information for the pay...

-

Denardos Country Store pays its employees on a biweekly basis. This week the payroll is $2,000. You issued Check 949 for $1,487 in payment of the payroll less the following amounts: Employees Federal...

-

Barbri Company ordinarily pays its employees on a weekly basis. Recently, one of the employees, Bernard Nagle, was sent from the home office on a three-week rip. Nagle has now returned to the office,...

-

You are to show the journal entries necessary to record the following items which occured in 2012: (a) May 1 Bought a van on credit from Deedon Garage for 6,000. (b) May 3 A debt of 100 owing from P....

-

In New York City, you are allowed to operate a taxi cab only if you carry a special taxi medallion made by the Taxi Commission of New York. Suppose 50,000 of these have been sold, and no further ones...

-

Calculate the HHV and LHV of liquid propane fuel (C3H8). Compare your results with the values in Table A-27 109258336914756 4202 367073567 88156996317585341863150 21052919097817828777650...

-

A device called a FabryPerot interferometer contains two parallel mirrors as shown in Figure P25.23. Multiple reflections occur between the inner mirror surfaces, and the waves emitted at the top can...

-

A high school basketball team is selling $10 raffle tickets as part of a fund-raising program. The first prize is a trip to the Bahamas valued at $5460, and the second prize is a weekend ski package...

-

show work Q1. (70%) Enos Printing Corp. uses a job order cost system. The following data summarize the operations related to the first quarter's production. Show your work clearly for a-i. Materials...

-

Internet Consulting Service, Inc., adjusts its accounts every month. The company's year-end unad- justed trial balance dated December 31, 2018 follows. (Bear in mind that adjusting entries already...

-

For each of the total gross earnings amounts recorded in the past five pay weeks for Hot Suds Car Wash, determine these taxes: employers FICA taxes (social security 6.2%, Medicare 1.45%) federal...

-

Employee benefits might include paid vacations and health insurance. Many employers calculate the cost of bene fits as a percentage of total salaries. INSTRUCTIONS Use the payroll register on page...

-

Use supply-and-demand diagrams to demonstrate how each of the following events (a-d) affects the market for S.U. apparel. Be sure to show and explain what happens to the equilibrium price and...

-

Locate a scholarly article relevant to how to present your financial plan for opening a Roller Skating Rink (from your draft business plan) to a lending institution--and describe your strategy for...

-

How would you expect seasonal fluctuations in demand to affect a rental company's decisions about pricing rented products such as wedding dresses or convertible cars? In terms of pricing principles,...

-

Do we drive technology, or does technology drive us? If technology drives us, what are the risks? The other side of the coin would be that we are able to stay ahead of technological transformations....

-

How do you explain the differences between the two analyses and what are the implications of using the BCG matrix in practice?

-

How do leadership styles, such as transformational leadership, shared leadership, and servant leadership, impact team dynamics, member motivation, and overall team effectiveness ?

-

The accompanying data file contains quarterly observations for 5 years. Calculate and interpret the seasonal indices for quarters 1 and 4.

-

In your audit of Garza Company, you find that a physical inventory on December 31, 2012, showed merchandise with a cost of $441,000 was on hand at that date. You also discover the following items...

-

Alice is a single mother, 37 years old, and has two qualifying children, ages 3 and 6. In 2017, she receives $3,600 alimony and earns $18,000 in wages resulting in $21,600 of AGI. Is Alice eligible...

-

Vincent anticipates that his actual tax liability for the tax year 2017 will be $12,000 and that federal income taxes withheld from his salary will be $9,000. Thus, when he files his 2017 income tax...

-

William and Maria Smith are a married couple filing jointly. They have no children and report the following items in 2017: Taxable income .................$70,000 Tax preferences...

-

ABC Company engaged in the following transaction in October 2 0 1 7 Oct 7 Sold Merchandise on credit to L Barrett $ 6 0 0 0 8 Purchased merchandise on credit from Bennett Company $ 1 2 , 0 0 0 . 9...

-

Lime Corporation, with E & P of $500,000, distributes land (worth $300,000, adjusted basis of $350,000) to Harry, its sole shareholder. The land is subject to a liability of $120,000, which Harry...

-

A comic store began operations in 2018 and, although it is incorporated as a limited liability company, it decided to be taxed as a corporation. In its first year, the comic store broke even. In...

Study smarter with the SolutionInn App