When considering a borrowers long-term debt, lenders often consider the debt to equity ratio. This ratio compares

Question:

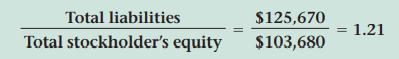

When considering a borrower’s long-term debt, lenders often consider the debt to equity ratio. This ratio compares the resources the lender will provide to the borrower’s resources. It is calculated by dividing total liabilities by total stockholders’ equity. Here’s an example:

This debt to equity ratio of 1.21 to 1 means that lenders would provide more resources than the borrower has. The higher the ratio, the higher is the lender’s claims on the applicant’s assets. A heavy reliance on creditors increases the risk that a business may not be able to meet its financial obligations during a business downturn.

INSTRUCTIONS

Obtain PETsMART’s most recent balance sheet from the Internet or a public library. Use this and the February 2004 balance sheet in Appendix F for the following tasks.

1. Calculate PETsMART’s debt to equity ratio for both years.

2. Compare how the ratio has changed. As a creditor, how would you interpret this change?

Step by Step Answer: