Bank B has $200 million variable rate loan in its assets portfolio; the rate is to be

Question:

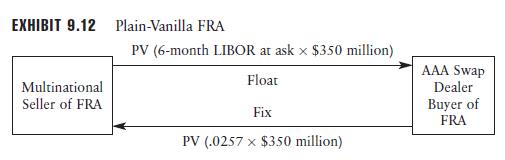

Bank B has $200 million variable rate loan in its assets portfolio; the rate is to be reset in the next three months. The revenue is exposed to interest rate risk. Bank B wishes to manage its exposure by selling 3 6 FRA with

notional principal of $200 million. Exhibit 9.13 presents the cash flow stream that is exchanged.

Bank B, paying a three-month LIBOR rate to be determined in three months, is expected to receive the fixed forward rate and a floating rate revenue from its portfolio of variable rate loans. What Bank B pays and receives on its variable rate loans would be offsetting transactions that transform the variable rate revenue to fixed rate revenue once the FRA shown in Exhibit 9.13 is consummated in three months.

Step by Step Answer:

Managing Global Financial And Foreign Exchange Rate Risk

ISBN: 9780471281153

1st Edition

Authors: Ghassem A. Homaifar