In the management discussion and analysis accompanying its 20XS financial statements, Tiber County reported that for the

Question:

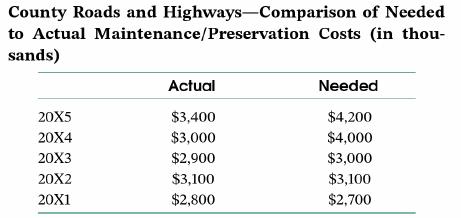

In the management discussion and analysis accompanying its 20XS financial statements, Tiber County reported that "for the fifth consecutive year revenues exceeded expenditures." However, a note included in required supplementary information disclosed the following:

The county has not been depreciating its infrastructure system but instead has been taking GASE Statement No. 34's modified approach.

1. What reservations might you have about the significance of the county's excess of revenues over expenditures in 20XS?

2. Suppose that you were the county's independent auditor. What reservation might you have about the county's reporting practices?

3. Suppose that the county was required to switch from the modified approach to the standard approach. As of year-end 20XS, the estimated initial cost of the roads was $100 million and their estimated useful life was 40 years.

a. How would the change from the modified approach to the standard approach affect the county's general fund excess of revenues over expenditures?

b. How would it affect the county's governmentwide excess of revenues over expenses?

Step by Step Answer:

Government And Not For Profit Accounting Concepts And Practices

ISBN: 9781119803898

9th Edition

Authors: Michael H. Granof, Saleha B. Khumawala, Thad D. Calabrese