The following relate to the town of Coupland (dollar amounts in thousands): Revenue to be recognized in

Question:

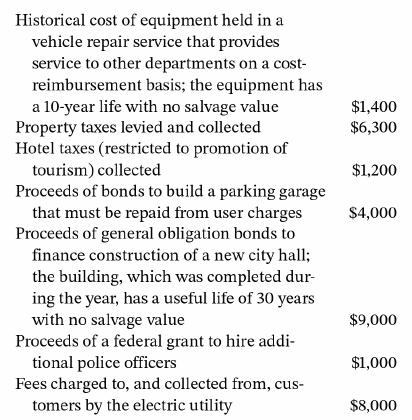

The following relate to the town of Coupland (dollar amounts in thousands):

Revenue to be recognized in the general fund

a. $0

b. $140

c. $900

d. $1,260

e . $1,040

f. $1,400

g. $2,200

h. $4,000

i. $6,300

j. $8,000

k. $8,500

l. $10,400

Transcribed Image Text:

Historical cost of equipment held in a vehicle repair service that provides service to other departments on a cost- reimbursement basis; the equipment has a 10-year life with no salvage value Property taxes levied and collected Hotel taxes (restricted to promotion of tourism) collected Proceeds of bonds to build a parking garage that must be repaid from user charges Proceeds of general obligation bonds to finance construction of a new city hall; the building, which was completed dur- ing the year, has a useful life of 30 years with no salvage value Proceeds of a federal grant to hire addi- tional police officers Fees charged to, and collected from, cus- tomers by the electric utility $1,400 $6,300 $1,200 $4,000 $9,000 $1,000 $8,000

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 46% (13 reviews)

Answered By

PALASH JHANWAR

I am a Chartered Accountant with AIR 45 in CA - IPCC. I am a Merit Holder ( B.Com ). The following is my educational details.

PLEASE ACCESS MY RESUME FROM THE FOLLOWING LINK: https://drive.google.com/file/d/1hYR1uch-ff6MRC_cDB07K6VqY9kQ3SFL/view?usp=sharing

3.80+

3+ Reviews

10+ Question Solved

Related Book For

Government And Not For Profit Accounting Concepts And Practices

ISBN: 9781119803898

9th Edition

Authors: Michael H. Granof, Saleha B. Khumawala, Thad D. Calabrese

Question Posted:

Students also viewed these Business questions

-

The following relate to the town of Coupland (dollar amounts in thousands): Equipment used in a vehicle repair service that provides service to other departments on a cost-reimbursement basis; the...

-

The following relate to three grants that the town of College Hills received from the state during its scal year ending December 31, 2015. Prepare journal entries to record the three grants. 1. A...

-

The financial statements of Mountainpeak Employment Services, Inc., reported the following accounts (adapted, with dollar amounts in thousands except for par value): Prepare the stockholders equity...

-

At the beginning of September, Selena Cantu started Cantu Wealth Management Consulting, a firm that offers financial planning and advice about investing and managing money. On September 30, the...

-

In order to see the effect of hours of sleep on tests of different skill categories (vocabulary, reasoning, and arithmetic), tests consisting of 20 questions each in each category were given to 16...

-

The particle of mass m is gently nudged from the equilibrium position A and subsequently slides along the smooth elliptical path which lies in a vertical plane. Determine the magnitude of its angular...

-

6-9. How does licensing differ from a joint venture?

-

BusinessWeek recently declared, We have entered the Age of the Internet, and observed that when markets for goods or services gain access to the Internet, more consumers and more businesses...

-

Common law rights and remedies apply only to non-unionized employees. True False Question 3 (1 point) Directors of corporations involved in directing the crime or participating in criminal act may be...

-

The Domino Sugar Corporation manufactures a sugar product by a continuous process, involving three production departmentsRefining, Sifting, and Packing. Assume that records indicate that direct...

-

Central School District is awarded a $400,000 federal grant to implement and test a new way of teaching middle school math. The award stipulates that the district must provide a 20 percent match. a....

-

The following relate to the town of Coupland (dollar amounts in thousands): Long-lived assets to be recognized in the general fund a. $0 b. $140 c. $900 d. $1,260 e . $1,040 f. $1,400 g. $2,200 h....

-

Amos began a business, Silver, Inc., on July 1, 2014. The business extracts and processes silver ore. During 2017, Amos becomes aware of the domestic production activities deduction (DPAD) and would...

-

Part 2 One Stop Electrical Shop are merchandisers of household fixtures & fittings. The business began the last quarter of 2020 (October to December) with 25 Starburst Wall Clocks at a total cost of...

-

A species of butterfly has three subspecies A, B, and C. A scientist is trying to classify observed. specimens into these subspecies based on the color of their wings, which can be blue, green, pink,...

-

Stock during the year were sold for $8 per share. On December 31 , Portland had no remaining treasury stock. Required: Prepare the necessary journal entries to record any transactions associated with...

-

2) 20 pts. A 2-kg block rests on a wedge that has a coefficient of friction between the wedge and block of 0.3. The system accelerated to the right. Determine the maximum acceleration of the system...

-

ABC Ltd. is concerning about its poor performance and considering whether or not dropping the production and sells of product R, which incurs losses of Birr 4000. Additional information: The salaries...

-

As of January 1, Year 5, the accounting records for High Tech Supply (HTS) showed Cash of $180,000, Common Stock of $120,000, and Retained Earnings of $60,000. During Year 5, HTS experienced the...

-

What exactly is a prima facie duty? How does an ethic of prima facie duties differ from monistic and absolutist ethical theories?

-

Why do many governments consider it unnecessary to prepare appropriation budgets for, and incorporate budgetary entries into the accounts of, their capital project funds?

-

1. Appropriation budgets are typically concerned with a. The details of appropriated expenditures b. Long-term revenues and expenditures c. Current operating revenues and expenditures d. Capital...

-

1. Appropriation budgets are typically concerned with a. The details of appropriated expenditures b. Long-term revenues and expenditures c. Current operating revenues and expenditures d. Capital...

-

Jen bought 100 shares of ABC stock at $15 a share on July 14, 2017. On August 7, 2018, she noticed that the stock had increased in value to $20 a share and decided to sell her shares. Jen's marginal...

-

Alex. Inci, buys 40 petcent of Steinbart Company on January 1, 2020, for $1.212.000. The equity method of accounting is to be used. Steinbart's net assets on that datewere $2.90 million. Any excess...

-

exercise 4-7 (Algo) Effects of transactions on income statement LO P2

Study smarter with the SolutionInn App