Marks Bowling Alleys adjusted trial balance as of December 31, 2024, is presented below: Requirements 1. Prepare

Question:

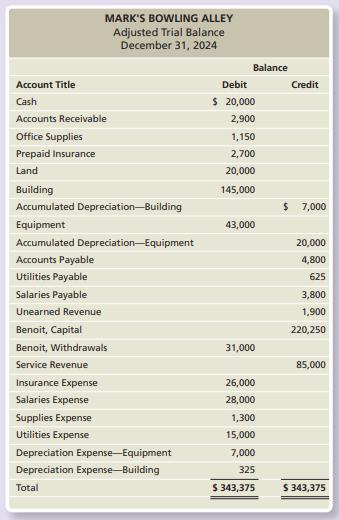

Mark’s Bowling Alley’s adjusted trial balance as of December 31, 2024, is presented below:

Requirements

1. Prepare the closing entries for Mark’s Bowling Alley.

2. Prepare a post-closing trial balance.

3. Compute the current ratio for Mark’s Bowling Alley.

Transcribed Image Text:

Account Title Cash Accounts Receivable Office Supplies Prepaid Insurance Land MARK'S BOWLING ALLEY Adjusted Trial Balance December 31, 2024 Building Accumulated Depreciation-Building Equipment Accumulated Depreciation Equipment Accounts Payable Utilities Payable Salaries Payable Unearned Revenue Benoit, Capital Benoit, Withdrawals Service Revenue Insurance Expense Salaries Expense Supplies Expense Utilities Expense Depreciation Expense-Equipment Depreciation Expense-Building Total Balance Debit $ 20,000 2,900 1,150 2,700 20,000 145,000 43,000 31,000 26,000 28,000 1,300 15,000 7,000 325 $ 343,375 Credit $ 7,000 20,000 4,800 625 3,800 1,900 220,250 85,000 $ 343,375

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 81% (11 reviews)

1 2 3 Current Ratio Total current assets Total current liabil...View the full answer

Answered By

Jinah Patricia Padilla

Had an experience as an external auditor in Ernst & Young Philippines and currently a Corporate Accountant in a consultancy company providing manpower to a 5-star hotel in Makati, Philippines, Makati Diamond Residences

5.00+

120+ Reviews

150+ Question Solved

Related Book For

Horngrens Accounting The Financial Chapters

ISBN: 9780136162186

13th Edition

Authors: Tracie Miller Nobles, Brenda Mattison

Question Posted:

Related Video

A trial balance is a list of all the general ledger accounts contained in the ledger of a business. This list will contain the name of each nominal ledger account and the value of that nominal ledger balance. Each nominal ledger account will hold either a debit balance or a credit balance

Students also viewed these Business questions

-

Matthews Bowling Alleys adjusted trial balance as of December 31, 2016, is presented below: Requirements 1. Prepare the closing entries for Matthews Bowling Alley. 2. Prepare a post-closing trial...

-

Mark's Bowling Alley's adjusted trial balance as of December 31, 2018, is presented below: Requirements 1. Prepare the closing entries for Mark's Bowling Alley. 2. Prepare a post-closing trial...

-

Prepare the closing entries for (a) Ending work in process and raw materials inventories and (b) Manufacturing summary. Use XXXs for amounts.

-

A physical pendulum of mass m = 3 . 3 6 kg is comprised of an odd shape that has a centre - of - mass a distance of d = 0 . 5 5 5 m from the pivot point. The pendulum is displaced from equilibrium to...

-

Determine the critical values of r for a = 0.05 and n = 20 in the following circumstances: a. Ha is two-tailed. b. Ha is one-tailed.

-

Define tourism.

-

Using the flowchart in Figure 127 as a guide, create a customer contact audit to identify specific points of interaction with customers.

-

Last year, Lakeshas Lounge Furniture Corporation had an ROE of 17.5 percent and a dividend payout ratio of 20 percent. What is the sustainable growth rate?

-

Your firm is considering an investment that will cost $750,000 today. The investment will produce cash flows of $150,000 in year 1. $200,000 in years 2 through 4, and $100,000 in year 5. The required...

-

Use the T Accounts for Moose Inc to create their Trial Balance as of December 31, 2022. The account numbers are in parentheses next to the account name. Trial Balance Account Number 100 110 120 130...

-

Selected accounts for Kebby Photography at December 31, 2024, follow: Requirements 1. Journalize Kebby Photographys closing entries at December 31, 2024. 2. Determine Kebby Photographys ending Kebby,...

-

Houston Veterinary Hospital completed the following worksheet as of December 31, 2024. Requirements 1. Complete the worksheet for Houston Veterinary Hospital. 2. Prepare the closing entries. 3....

-

Explain the need for accounting standards.

-

Part 1 of 4 05 points abook Print References Required information Problem 24-2A (Algo) Payback period, accounting rate of return, net present value, and net cash flow calculation LO P1, P2, P3 [The...

-

Keenan Music's CEO has been pondering about the recent proposal of the Specialty Guitar Project. The accountant has done a capital budgeting analysis on the project and outlined the conditions that...

-

On July 1, 2025, Sheridan Co. pays $15,000 to Blue Spruce Insurance Co. for a 2-year insurance contract. Both companies have fiscal years ending December 31. (a1) Journalize the entry on July 1 and...

-

A CU triaxial test with c = 20 psi is performed on a sand and a deviator stress of 80 psi fails the specimen. Previous tests revealed that the effective friction angle for this sand is 35. Calculate...

-

Haliburton Mills Inc. is a large producer of men's and women's clothing. The company uses standard costs for all of its products. The standard costs and actual costs for a recent period are given...

-

Find an expression for B 2 if B = x(d/dx) and find B 2 f if f = bx 4 .

-

Distinguish between the work performed by public accountants and the work performed by accountants in commerce and industry and in not-for-profit organisations.

-

A credit purchase denominated in pesos, followed by weakness in the peso results in a foreign-currency gain or loss for a Canadian business?

-

Shyster Originals Corp. purchased US$10,000 of American maple syrup to sell in Canada. At the time of the June 2 purchase, the exchange rate was 1.3504. When the payment was made on July 28, the...

-

Mentacos Inc. purchased inventory from a French company, agreeing to pay 150,000 euros. On the purchase date, the euro was quoted at $1.55. When Mentacos Inc. paid the debt, the price of a euro was...

-

please help Problem 13-7 (Algo) Prepare a Statement of Cash Flows [LO13-1, LO13-2] [The following information applies to the questions displayed below.] Comparative financial statements for Weaver...

-

A firm has 1000 shareholders, each of whom own $59 in shares. The firm uses $28000 to repurchase shares. What percentage of the firm did each of the remaining shareholders own before the repurchase,...

-

Vancouver Bank agrees to lend $ 180,000 to Surrey Corp. on November 1, 2020 and the company signs a six-month, 6% note maturing on May 1, 2021. Surrey Corp. follows IFRS and has a December 31 fiscal...

Study smarter with the SolutionInn App