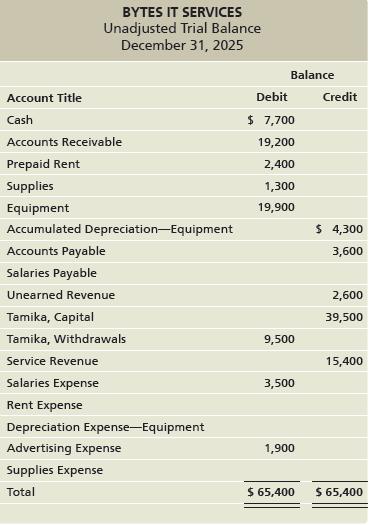

The unadjusted trial balance of Bytes IT Services at December 31, 2025, and the data needed for

Question:

The unadjusted trial balance of Bytes IT Services at December 31, 2025, and the data needed for the adjustments follow.

Adjustment data at December 31 follow:

a. On December 15, Bytes IT Services contracted to perform services for a client receiving \($2,600\) in advance. Bytes IT Services recorded this receipt of cash as Unearned Revenue. As of December 31, Bytes IT Services has completed \($1,100\) of the services.

b. Bytes IT Services prepaid two months of rent on December 1. (Assume the Prepaid Rent balance as shown on the unadjusted trial balance represents the two months of rent prepaid on December 1.)

c. Bytes IT Services used \($600\) of supplies.

d. Depreciation for the equipment is \($900\).

e. Bytes IT Services received a bill for December’s online advertising, \($900.\) Bytes IT Services will not pay the bill until January. (Use Accounts Payable.)

f. Bytes IT Services pays its employees on Monday for the previous week’s salaries. Its employees earn \($1,500\) for a five-day workweek. December 31 falls on Wednesday this year.

g. On October 1, Bytes IT Services agreed to provide four-months of IT services (beginning October 1) for a customer for \($3,200.\) Bytes IT Services has completed the services every month, but payment has not yet been received and no entries have been made.

Requirements

1. Journalize the adjusting entries on December 31.

2. Using the unadjusted trial balance, open the T-accounts with the unadjusted balances. Post the adjusting entries to the T-accounts.

3. Prepare the adjusted trial balance.

4. How will Bytes IT Services use the adjusted trial balance?

Step by Step Answer:

Horngrens Accounting The Financial Chapters

ISBN: 9780137884858

14th Edition

Authors: Brenda Mattison, Tracie Miller-Nobles