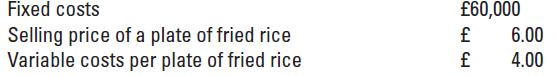

Calculate the breakeven point in both units and sales value a. 30,000 plates of fried rice and

Question:

Calculate the breakeven point in both units and sales value

a. 30,000 plates of fried rice and £60,000

b. 180,000 plates of fried rice and £80,000

c. 10,000 plates of fried rice and £180,000

d. 30,000 plates of fried rice and £180,000

You are given the following details regarding the operations of Cheng Hi Fried Rice Restaurant.

Transcribed Image Text:

Fixed costs Selling price of a plate of fried rice Variable costs per plate of fried rice £60,000 £ વા વા £ 6.00 4.00

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 60% (10 reviews)

The breakeven point in units can be calculated using the formula Fixed Costs Selling Price per ...View the full answer

Answered By

Labindao Antoque

I graduated in 2018 with a Bachelor of Science degree in Psychology from Dalubhasaan ng Lungsod ng San Pablo. I tutored students in classes and out of classes. I use a variety of strategies to tutor students that include: lecture, discussions about the subject matter, problem solving examples using the principles of the subject matter being discussed in class , homework assignments that are directed towards reinforcing what we learn in class , and detailed practice problems help students to master a concept. I also do thorough research on Internet resources or textbooks so that I know what students need to learn in order to master what is being taught in class .

0.00

0 Reviews

10+ Question Solved

Related Book For

Horngrens Cost Accounting A Managerial Emphasis

ISBN: 9780135628478

17th Edition

Authors: Srikant M. Datar, Madhav V. Rajan

Question Posted:

Students also viewed these Business questions

-

The Famous Shoe Company operates a chain of shoe stores that sell 10 different styles of inexpensive men's shoes with identical unit costs and selling prices. A unit is defined as a pair of shoes....

-

The Light Company manufactures a single type of desk-lamp which has a selling price of 49 per un Annual sales volume is 8,000 units. The company is considering changing its production methods ar...

-

Calculate the breakeven point in units for each product. Product Fixed costs Contribution margin $ 9,000,000 540,000 11,000 20 15,000 150 3,000

-

The advantages of the computerized conversion process model " What is the EOQ model? (For self-study and research) What is JIT? (Self study and research) A firm expects to sell 2000 units of its...

-

How are tools such as a process chart and a worker-machine chart useful?

-

Harold Limited's condensed financial statements provide the following information: Instructions (a) Determine the following: 1. Current ratio at December 31, 2017 2. Acid-test ratio at December 31,...

-

Define semantics.

-

The Maple Lake branch of Buffalo State Savings Bank (BSSB) is a retail branch in a rapidly growing residential area. It services individuals and local businesses. To support its services, the branch...

-

Pharoah Inc. wishes to accumulate $1,040,000 by December 31, 2030, to retire bonds outstanding. The company deposits $160,000 on December 31, 2020, which will earn interest at 12% compounded...

-

Lute Retail Ltd transfers $357,700 of its accounts receivable to an independent trust in a securitization transaction on July 11, 2014, receiving 97% of the receivables balance as proceeds. Lute will...

-

Fill in the blanks for each of the following independent cases. Variable Case Revenues Costs $4,250 a. b. C. d. $6,600 $3,500 $2,400 Fixed Costs Total Costs $2,975 $6,000 $1,800 Operating...

-

What are some of the assumptions underlying breakeven analysis in a multiple products environment?

-

Refer to the model for monthly differences in the exchange rate shown in Figure 9. Calculate the mean and variance of the number of times, in two years, that the absolute value of a one-month...

-

Below are incomplete financial statements for Hurricane, Incorporated Required: Calculate the missing amounts. Complete this question by entering your answers in the tabs below. Income Statement Stmt...

-

TBTF Incorporated purchased equipment on May 1, 2021. The company depreciates its equipment using the double-declining balance method. Other information pertaining to the equipment purchased by TBTF...

-

Coco Ltd. manufactures milk and dark chocolate blocks. Below is the information relating to each type of chocolate. Milk Chocolate Selling price per unit $6 Variable cost per unit $3 Sales mix 4 Dark...

-

Data related to 2018 operations for Constaga Products, a manufacturer of sewing machines: Sales volume 5,000 units Sales price $300.00 per unit Variable production costs Direct materials 75.00 per...

-

6. (20 points) Sections 3.1-3.5, 3.7 Differentiate the following functions, state the regions where the functions are analytic. a. cos(e*) b. 1 ez +1 c. Log (z+1) (Hint: To find where it is analytic,...

-

Solve each system, using the method indicated, if possible. (Gauss-Jordan) 3x + 5y = -5 -2x + 3y = 16

-

Draw the major product for each of the following reactions: (a) (b) (c) 1) 9-BBN 2) H2O2, NaOH 1) Disiamylborane 2) H20, NaOH

-

Green Paper Delivery has decided to analyze the profitability of five new customers. It buys recycled paper at $ 20 per case and sells to retail customers at a list price of $ 26 per case. Data...

-

Antelope Manufacturing makes a component called A1030. This component is manufactured only when ordered by a customer, so Antelope keeps no inventory of A1030. The list price is $ 115 per unit, but...

-

Rod Manufacturing Company produces metal rods for their customers. Its wholesale division is the focus of our analysis. Management of the company wishes to analyze the profitability of the three key...

-

On April 1, year 1, Mary borrowed $200,000 to refinance the original mortgage on her principal residence. Mary paid 3 points to reduce her interest rate from 6 percent to 5 percent. The loan is for a...

-

Give a numerical example of: A) Current liabilities. B) Long-term liabilities?

-

Question Wonder Works Pte Ltd ( ' WW ' ) produces ceramic hair curlers to sell to department stores. The production equipment costs WW $ 7 0 , 0 0 0 four years ago. Currently, the net book value...

Study smarter with the SolutionInn App