Cash budgeting for distributor. (CMA) Martha Jonat, the marketing vice-president of Montrose Inc., a distributor, has completed

Question:

Cash budgeting for distributor. (CMA) Martha Jonat, the marketing vice-president of Montrose Inc., a distributor, has completed the sales budget for 2010, shown below:Mark Phillips, the controller, has the responsibility of preparing the cash budget. Additional information required to assist in preparing the cash budget follows:

a. Montrose's collection of accounts receivable is expected to continue as in the past: 60% of billings are collected the month after the sale and the remaining 40% two months after. Bad debts have been negligible and are expected to continue as such.

b. Purchases of the products distributed by Montrose form the largest expenditure compo- nent of the company and is traditionally 40% of revenues. The purchases are received on the following basis: 70% one month before sale and 30% during the month of sale.

c. Historically, 75% of accounts payable have been paid one month after receipt of the purchased products and the remaining 25% paid two months after receipt.

d. Hourly wages and fringe benefits, which approximate 30% of the current month's revenues, are paid in the month incurred.

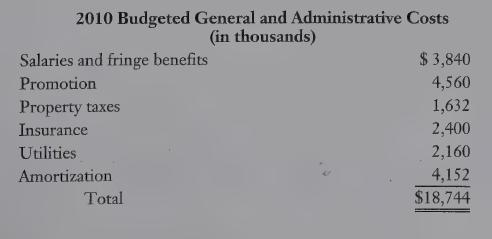

e. General and administrative expenses are projected to be $18,744,000 for the year. The breakdown of these expenses is as follows:

All expenditures are paid uniformly throughout the year, except the property taxes, which are paid at the end of each quarter in four equal instalments.

f. Income tax payments are made at the beginning of each calendar quarter based on the income of the prior quarter. Montrose is subject to an effective income tax rate of 40%.

The operating income for the first quarter of 2010 is projected to be $3,840,000. ‘The company pays 100% of the estimated tax payment.

g. A minimum cash balance of $600,000 is maintained at all times. If the cash balance is less than $600,000 at the end of each month, the company borrows amounts necessary to maintain this balance. All amounts borrowed are repaid out of subsequent positive cash flow. The April 1, 2010 opening cash balance is expected to be $600,000.

h. There is no short-term debt as of April 1, 2010.

The company fiscal year corresponds with the calendar year for both financial reporting and tax purposes.

he.

REQUIRED 1. Prepare a cash budget for Montrose by month:for the second quarter of 2010. Ignore any interest expense associated with borrowing. .

2. Why is cash budgeting important for Montrose?LO1

Step by Step Answer:

Cost Accounting A Managerial Emphasis

ISBN: 9780135004937

5th Canadian Edition

Authors: Charles T. Horngren, Foster George, Srikand M. Datar, Maureen P. Gowing