Cash budgeting. UltraMag, a manufacturer of high-quality electronic components, plans a major capital investment over a six-month

Question:

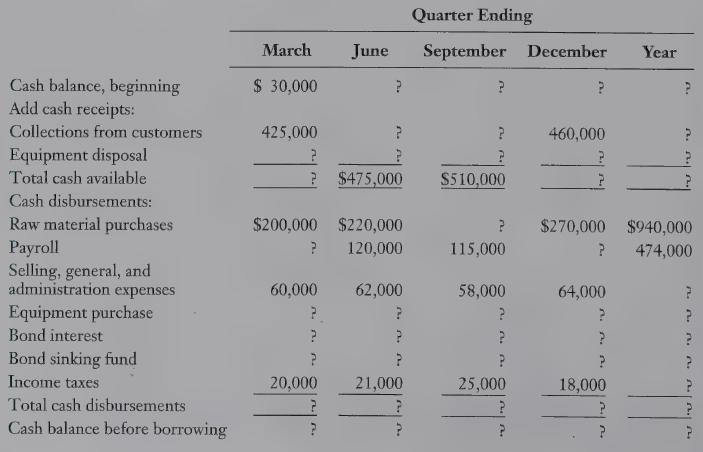

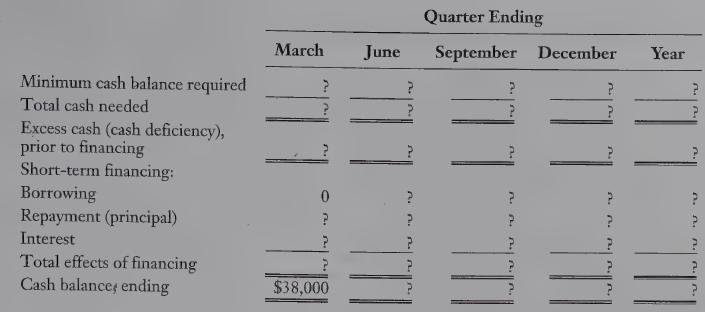

Cash budgeting. UltraMag, a manufacturer of high-quality electronic components, plans a major capital investment over a six-month period starting at the beginning of the second quarter of its fiscal year ending December 31, 2010. The firm estimates the total investment cost to be $80 million with a 25% down payment at the end of the first quarter and continu- ing with equal instalments at the end of each month for the following six months. The firm expects to sell the replaced equipment at the end of the fourth quarter for $5 million. The company sold $250 million 10-year 9% bonds three years previously. The interest on these bonds is payable semi-annually on May 31 and November 30. A specific covenant for these bonds requires the firm to maintain a minimum cash balance of $30 million at all times. As well, the firm is required to deposit $20 million into a sinking fund on or before May 31 of each year. UltraMag has an open credit line with the Royal Bank for short-term loans at an interest rate of 12% per annum. The firm can draw up to $100 million at the beginning of each quarter and repay total interest owed and as much of the principal outstanding balance as possible at the end of each quarter. All borrowings and repayments are to be made in increments of $1 million. Interest on the loans is payable at the end of each month. As of the end of the current year, UltraMag has yet to draw any funds against this line of credit. The CFO, Martina Juarez, has determined that any excess cash on hand over $50 million should be applied to pay down short-term bank loans or should be invested in marketable securities at the end of the quarter. The firm is likely to earn a 5 percent annual return on marketable securities. REQUIRED Use the following data to complete UltraMag's quarterly cash budgets for the year ending December 31, 2010 (all amounts in thousands).LO1

Step by Step Answer:

Cost Accounting A Managerial Emphasis

ISBN: 9780135004937

5th Canadian Edition

Authors: Charles T. Horngren, Foster George, Srikand M. Datar, Maureen P. Gowing