Multinational firms, comparison of profit, ROI, RI, and EVA. Kase Tractor Company, a multinational company, allows its

Question:

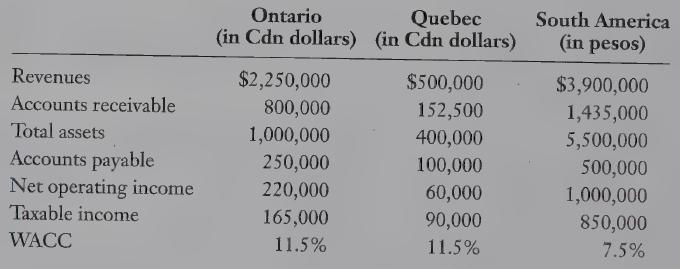

Multinational firms, comparison of profit, ROI, RI, and EVA. Kase Tractor Company, a multinational company, allows its divisions to operate as autonomous units. In the year 2008 it established a division in a South American country as a subsidiary corporation, with an initial investment in total assets of 6.5 million pesos (the local currency), which cost the company $3,250,000 Canadian at the time. The company sent an experienced manager to run the division, and gave her a target of 13% required rate of return, promising a bonus if this was met and/or exceeded. At the end of the first year (2008), the subsidiary manager was pleased to report a 20% ROI with sales of 1,000,000 Canadian dollars. The current exchange rate as of the end of the year 2009 was 3 pesos to 1 Canadian dollar. The exchange rate at the end of 2008 was the same as when the initial investment was made. The tax rate for the two Canadian divisions is 35% and for the South American division is 20%. Other operating data for 2009 follow:

REQUIRED 1. Compute the return on investment for each division in 2009 and calculate the South American subsidiary’s income in pesos for the year 2008.

2. Compute the EVA for each division.

3. What other ratio could be calculated for performance evaluation? Explain why it would be beneficial.

4. Calculate the RI of the South American subsidiary in Canadian dollars for the years 2008 and 2009, 5. Explain at least two factors that may have contributed to the increase or decrease in RI between 2008 and 2009 in the South American division.LO1

Step by Step Answer:

Cost Accounting A Managerial Emphasis

ISBN: 9780135004937

5th Canadian Edition

Authors: Charles T. Horngren, Foster George, Srikand M. Datar, Maureen P. Gowing