Multinational firms, differing risk, comparison of profit, ROI, and RI. Zzwuig Multina- tional Inc. has divisions in

Question:

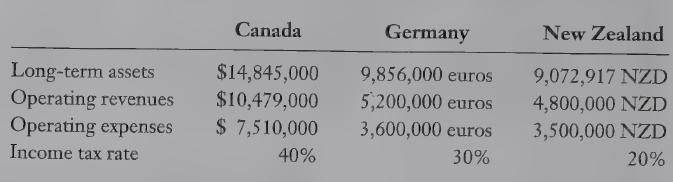

Multinational firms, differing risk, comparison of profit, ROI, and RI. Zzwuig Multina- tional Inc. has divisions in Canada, Germany, and New Zealand. The Canadian division is the oldest and most established of the three, and has a cost of capital of 6%. The German division was started three years ago when the exchange rate for euros was 1 = $1.25. Although it is a large and powerful division of Zzwuig Inc., its cost of capital is 10%. The New Zealand division was started this year, when the exchange rate was 1 New Zealand Dollar (NZD) = $0.64. Its cost of capital is 13%. Average exchange rates for the current year are 1€ = $1.32 and 1 NZD = $0.67. Other information for the three divisions includes:

REQUIRED 1. ‘Translate the German and New Zealand information into dollars to make the divisions comparable.

Find the after-tax operating income for each division and compare the profits.

2. Calculate ROI using after-tax operating income. Compare among divisions.

3. Use after-tax operating income and the individual cost of capital of each division to calculate residual income and compare.

4. Redo requirement 2 using pretax operating income instead of net income. Why is there a big difference, and what does it mean for performance evaluation?LO1

Step by Step Answer:

Cost Accounting A Managerial Emphasis

ISBN: 9780135004937

5th Canadian Edition

Authors: Charles T. Horngren, Foster George, Srikand M. Datar, Maureen P. Gowing