ROI, RI, and multinational firms. Konekopf Corporation has a division in Canada and another in France. The

Question:

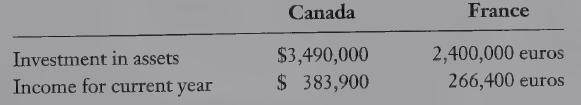

ROI, RI, and multinational firms. Konekopf Corporation has a division in Canada and another in France. The investment in the French assets was made when the exchange rate was $1.20 per euro. The average exchange rate for the year was $1.30 per euro. The exchange rate at the end of the fiscal year was $1.38 per euro. Income and investment for the two divisions are:

REQUIRED 1. The required return for Konekopf is 10%. Calculate ROI and RI for the two divisions. For the French division, calculate these measures using both dollars and euros. Which division is doing better?

2. What are the advantages and disadvantages of translating the French division information from euros to dollars?LO1

Step by Step Answer:

Cost Accounting A Managerial Emphasis

ISBN: 9780135004937

5th Canadian Edition

Authors: Charles T. Horngren, Foster George, Srikand M. Datar, Maureen P. Gowing