Risk-sharing, incentives, benchmarking, multiple tasks. Acme Inc. is a diversified multi- divisional corporation. One of its business

Question:

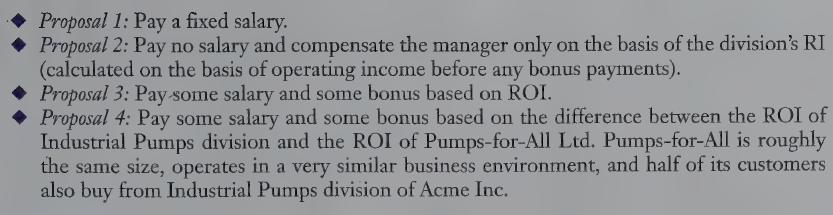

Risk-sharing, incentives, benchmarking, multiple tasks. Acme Inc. is a diversified multi- divisional corporation. One of its business units manufactures and sells industrial pumps. Acme's corporate management gives Industrial Pumps management considerable operating and investment autonomy in running the division. Cynthia Franco is an exceptional manager with a brilliant career within Industrial Pumps division and Acme will offer her the opportu- nity to become the new vice-president of industrial products. Acme has a handful of candi- dates to become the general manager of Industrial Pumps, but all of them lack the internal motivation that Cynthia has shown. Acme Inc. is considering how it should compensate the new general manager of the division.

REQUIRED 1. Evaluate each of the four proposals, specifying the advantages and disadvantages of each.

2. One of the candidates complains that the fourth proposal is unfair because the performance of another firm, over which he has no control, is included in his performance evaluation measure. Is his complaint valid? Why or why not?

3. Now suppose the Industrial Pumps manager has no authority for making capital investment decisions. Corporate marlagement makes these decisions. Is return on investment a good performance measure to use to evaluate the divisional manager? Is return on investment a good measure to evaluate the economic viability of the Industrial Pumps division? Explain.

4. Industrial Pumps’ salespersons are responsible for selling and providing customer service and support. Sales are easy to measure. Although customer service is very important to Industrial Pumps in the long run, it has not yet implemented customer-service measures. Cynthia Franco recommended compensating her sales force only on the basis of sales commissions paid for each pump sold. She cites two advantages to this plan:

(a) it creates very strong incentives for the sales force to work hard and

(b) the company pays salespersons only when the company itself is earning revenues and has cash. Do you like her plan? Why or why not?LO1

Step by Step Answer:

Cost Accounting A Managerial Emphasis

ISBN: 9780135004937

5th Canadian Edition

Authors: Charles T. Horngren, Foster George, Srikand M. Datar, Maureen P. Gowing