Executive performance measurement and compensation. The Vaughan Speed Taxi company is a young company that operates a

Question:

Executive performance measurement and compensation. The Vaughan Speed ‘Taxi company is a young company that operates a fleet of six taxis in the Greater ‘Toronto Area. The owner relies on the abilities of two managers to run each business: Airport and York. At the end of each month, the owner evaluates the performances of each business. His evaluations determine the size of the manager bonus. If the business achieved an annual ROA of 20% then the manager gets $1,000. The bonus is also augmented by $1 for every $10 the business exceeded its profit target.

However, the bonus contract gives the owner the right to make subjective adjustments for the effects of factors he deems outside the control of the managers. In the past few months he had made such adjustments for the adverse effects on revenue of having major construction and delays in the airport. By far the largest uncontrollable factor for the business at York is the weather. In particular, rides and sales volume increase sharply when it rains or snows.

The budget, which was updated monthly, was prepared based on an assumption of hours of good weather. Inevitably, though, those assumptions were not accurate.

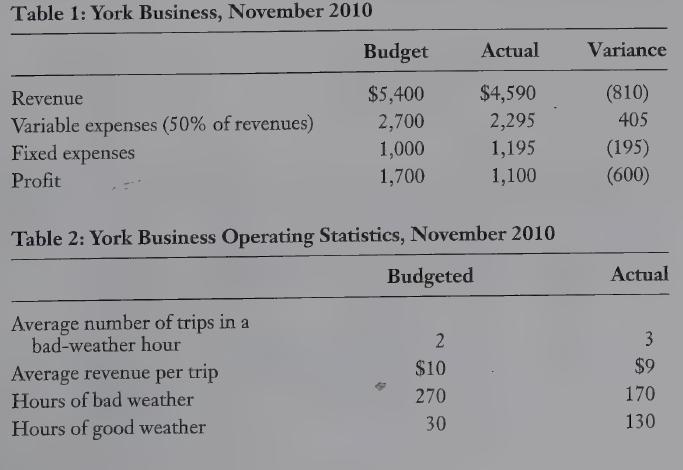

The month of November 2010 was not a typical month, and it did not snow and rain as much as had been assumed in the budget. Actual profits for the York business were below the budgeted profit level as shown in Table 1. Table 2 shows some operating assumptions and statistics for the month. The York line of business has $60,000 of total assets and is available every day, 10 hours per day. The taxi drivers are paid the legally required minimum wage plus a fixed amount for each trip completed, so labour costs are highly variable with revenues.

REQUIRED 1. How large will be the bonus for the York business line manager in November 2010?

2. Was the York business line properly managed in November 2010? Support your arguments with numbers.LO1

Step by Step Answer:

Cost Accounting A Managerial Emphasis

ISBN: 9780135004937

5th Canadian Edition

Authors: Charles T. Horngren, Foster George, Srikand M. Datar, Maureen P. Gowing