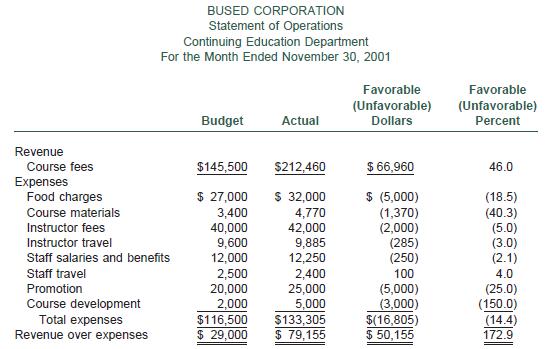

59. (Analyzing cost control) The financial results for the Continuing Education Department of BusEd Corporation for November

Question:

59. (Analyzing cost control) The financial results for the Continuing Education Department of BusEd Corporation for November 2001 are presented in the schedule at the end of the case. Mary Ross, president of BusEd, is pleased with the final results but has observed that the revenue and most of the costs and expenses of this department exceeded the budgeted amounts. Barry Stein, vice president of the Continuing Education Department, has been requested to provide an explanation of any amount that exceeded the budget by 5 percent or more.

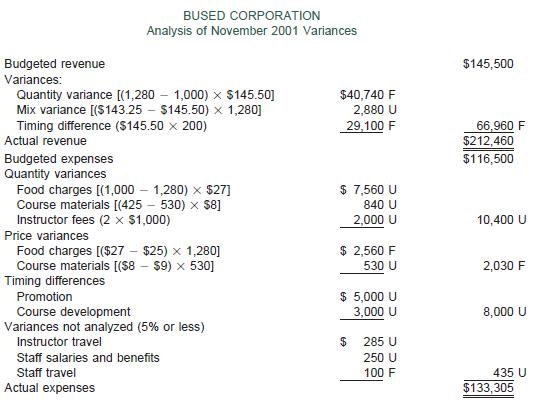

Stein has accumulated the following facts to assist in his analysis of the November results:

• The budget for calendar year 2001 was finalized in December 2000, and at that time, a full program of continuing education courses was scheduled to be held in Chicago during the first week of November 2001. The courses were scheduled so that eight courses would be run on each of the five days during the week. The budget assumed that there would be 425 participants in the program and 1,000 participant days for the week.

• BusEd charges a flat fee of $150 per day of course instruction, so the fee for a three-day course would be $450. BusEd grants a 10 percent discount to persons who subscribe to its publications. The 10 percent discount is also granted to second and subsequent registrants for the same course from the same organization. However, only one discount per registration is allowed.

Historically, 70 percent of the participant day registrations are at the full fee of $150 per day, and 30 percent of the participant day registrations receive the discounted fee of $135 per day. These percentages were used in developing the November 2001 budgeted revenue.

• The following estimates were used to develop the budgeted figures for course-related expenses.

Food charges per participant day (lunch/coffee breaks) $27 Course materials per participant $8 Instructor fee per day $1,000

• A total of 530 individuals participated in the Chicago courses in November 2001, accounting for 1,280 participant days. This number included 20 persons who took a new, two-day course on pension accounting that was not on the original schedule; thus, on two of the days, nine courses were offered, and an additional instructor was hired to cover the new course.

The breakdown of the course registrations were as follows:

Full fee registrations 704 Discounted fees Current periodical subscribers 128 New periodical subscribers 128 Second registrations from the same organization 320 Total participant day registrations 1,280

• A combined promotional mailing was used to advertise the Chicago program and a program in Cincinnati that was scheduled for December 2001.

The incremental costs of the combined promotional price were $5,000, but none of the promotional expenses ($20,000) budgeted for the Cincinnati program in December will have to be incurred. This earlier-than-normal promotion for the Cincinnati program has resulted in early registration fees collected in November as follows (in terms of participant days):

Full fee registrations 140 Discounted registrations 60 Total participant day registrations 200

• BusEd continually updates and adds new courses, and includes $2,000 in each monthly budget for this purpose. The additional amount spent on course development during November was for an unscheduled course that will be offered in February for the first time.

Barry Stein has prepared the following quantitative analysis of the November 2001 variances:

After reviewing Barry Stein’s quantitative analysis of the November variances, prepare a memorandum addressed to Mary Ross explaining the following: (See chapter 18 for more discussion of revenue variances.)

a. The cause of the revenue mix variance

b. The implication of the revenue mix variance

c. The cause of the revenue timing difference

d. The significance of the revenue timing difference

e. The primary cause of the unfavorable total expense variance

f. How the favorable food price variance was determined g. The impact of the promotion timing difference on future revenues and expenses h. Whether or not the course development variance has an unfavorable impact on the company.

Step by Step Answer:

Cost Accounting Traditions And Innovations

ISBN: 9780324180909

5th Edition

Authors: Jesse T. Barfield, Cecily A. Raiborn, Michael R. Kinney