(Product line) Festival Packing Company sells two major lines of products, fish and chicken, to grocery chains...

Question:

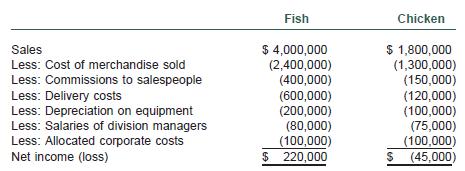

(Product line) Festival Packing Company sells two major lines of products, fish and chicken, to grocery chains and food wholesalers. Income statements showing revenues and costs of fiscal year 2000 for each product line follow:

Management is concerned about profitability of chicken sales and is considering the possibility of dropping the line. Management estimates that the equipment currently used to process chickens could be rented to a competitor for $85,000 annually. If the chicken product line is dropped, allocated corporate costs will decrease from a total of $200,000 to $185,000; and all employees, including the manager of the product line, would be dismissed. The depreciation would be unaffected by the decision, but $105,000 of the delivery costs charged to the chicken line could be eliminated if the chicken product line is dropped.

a. Recast the above income statements in a format that provides more information in making this decision regarding the chicken product line.

b. What is the net advantage or disadvantage (change in total company pretax profits) of continuing sales of chicken?

c. Should the company be concerned about losing sales of fish products if it drops the chicken line? Explain.

d. How would layoffs that would occur as a consequence of dropping the chicken line potentially adversely affect the whole company?

Step by Step Answer:

Cost Accounting Traditions And Innovations

ISBN: 9780324180909

5th Edition

Authors: Jesse T. Barfield, Cecily A. Raiborn, Michael R. Kinney