(Special order) Hastings Group is a multiproduct company with several manufacturing plants. The Cincinnati Plant manufactures and...

Question:

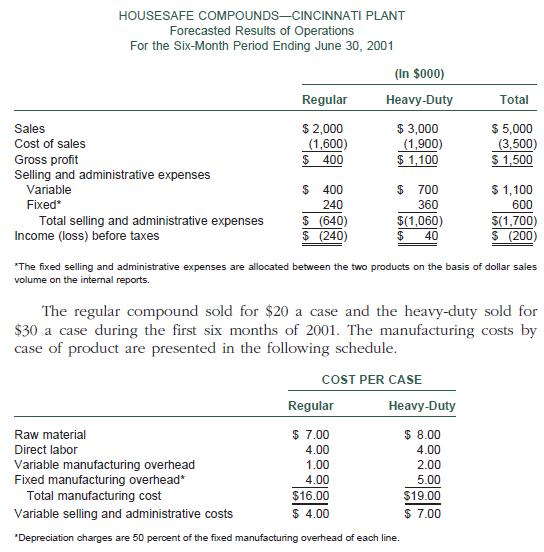

(Special order) Hastings Group is a multiproduct company with several manufacturing plants. The Cincinnati Plant manufactures and distributes two household cleaning and polishing compounds, regular and heavy-duty, under the HouseSafe label. The forecasted operating results for the first six months of 2001, when 100,000 cases of each compound are expected to be manufactured and sold, are presented in the following statement:

Each product is manufactured on a separate production line. Annual normal manufacturing capacity is 200,000 cases of each product. However, the plant is capable of producing 250,000 cases of regular compound and 350,000 cases of heavy-duty compound annually.

The schedule below reflects the consensus of top management regarding the price/volume alternatives for the HouseSafe products for the last six months of 2001. These are essentially the same alternatives management had during the first six months of 2001.

REGULAR COMPOUND HEAVY-DUTY COMPOUND Alternative Sales Alternative Sales Prices Volume Prices Volume (per case) (in cases) (per case) (in cases)

$18 120,000 $25 175,000 20 100,000 27 140,000 21 90,000 30 100,000 22 80,000 32 55,000 23 50,000 35 35,000 Top management believes the loss for the first six months reflects a tight profit margin caused by intense competition. Management also believes that many companies will be forced out of this market by next year and profits should improve.

a. What unit selling price should Hastings Group select for each of the House-

Safe compounds for the remaining six months of 2001? Support your answer with appropriate calculations.

b. Without prejudice to your answer for requirement (a), assume the optimum price/volume alternatives for the last six months were a selling price of $23 and volume level of 50,000 cases for the regular compound and a selling price of $35 and volume of 35,000 cases for the heavy-duty compound.

1.

Should Hastings Group consider closing down its operations until 2002 in order to minimize its losses? Support your answer with appropriate calculations.

2.

Identify and discuss the qualitative factors that should be considered in deciding whether the Cincinnati plant should be closed down during the last six months of 2001. (CMA adapted)

Step by Step Answer:

Cost Accounting Traditions And Innovations

ISBN: 9780324180909

5th Edition

Authors: Jesse T. Barfield, Cecily A. Raiborn, Michael R. Kinney