Bev and Ken Hair have been married for 3 years. They live at 3567 River Street, Springfield,

Question:

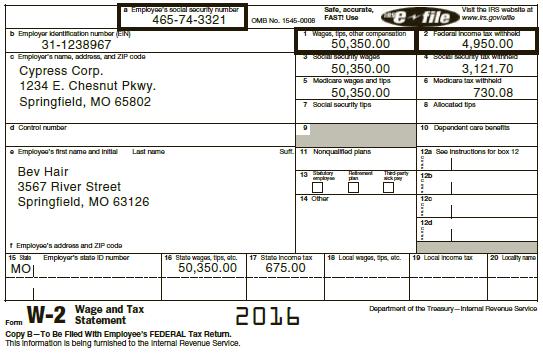

Bev and Ken Hair have been married for 3 years. They live at 3567 River Street, Springfield, MO 63126. Ken is a full-time student at Southwest Missouri State University (SMSU) and Bev works as an accountant at Cypress Corporation. Bev’s Social Security number is 465-74-3321 and Ken’s is 465-57-9934. Ken’s birthdate is January 12, 1990 and Bev’s birthdate is November 4, 1992. Bev’s earnings and income tax withholdings for 2016 are reported on the following Form W-2:

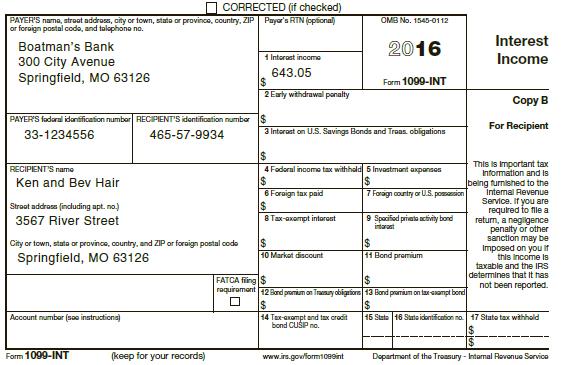

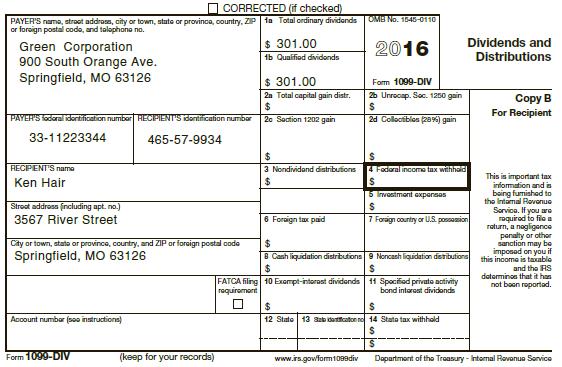

The Hairs have interest income of $1,000 on City of St. Louis bonds. During 2016, Bev and Ken received the following Forms 1099-INT and DIV:

Ken is an excellent student at SMSU. He was given a $1,750 scholarship by the university to help pay educational expenses. The scholarship funds were used by Ken for tuition and books. Ken also had a part-time job at SMSU. He was paid $2,525 on a W-2 for helping out in the Dean’s office. There was no income tax withheld on the amount paid to Ken from this job.

Last year, Bev was laid off from her former job and was unemployed during January 2016. She was paid $1,825 of unemployment compensation until she started work with her current employer, Cypress Corporation.

Ken has a 4-year-old son, Robert R. Hair, from a prior marriage. During 2016, he paid his ex-wife $300 per month in child support. Robert is claimed as a dependent by Ken’s ex-wife.

During 2016, Ken’s aunt died. The aunt, in her will, left Ken $15,000 in cash. Ken deposited this money in the Boatman’s Bank savings account.

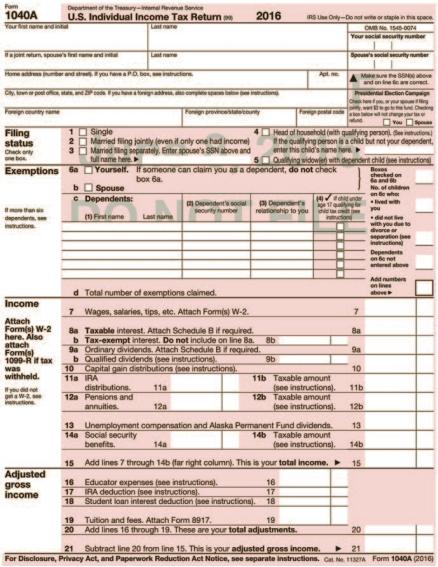

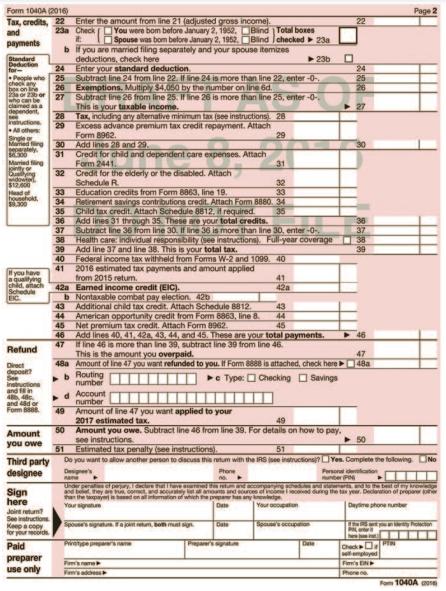

Required: Complete the Hair’s federal tax return for 2016. Use Form 1040A and the Qualified Dividends and Capital Gain Tax Worksheet on Pages 2-49 through 2-51. Make realistic assumptions about any missing data.

Form 1040A:

Step by Step Answer:

Income Tax Fundamentals 2017

ISBN: 9781305872738

35th Edition

Authors: Gerald E. Whittenburg, Steven Gill, Martha Altus Buller