Determine from the tax table in Appendix A the amount of the income tax for each of

Question:

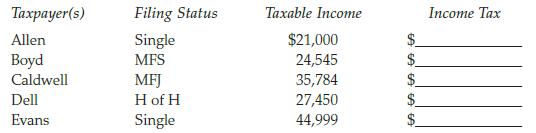

Determine from the tax table in Appendix A the amount of the income tax for each of the following taxpayers for 2020:

Transcribed Image Text:

Taxpayer(s) Allen Boyd Caldwell Dell Evans Filing Status Single MFS MFJ H of H Single Taxable Income $21,000 24,545 35,784 27,450 44,999 GA GA GA GA GA Income Tax

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 66% (9 reviews)

Allen 2326 ...View the full answer

Answered By

Simon kingori

I am a tier-one market researcher and content developer who has been in this field for the last six years. I’ve run the freelancing gamut; from market research, data mining and SEO/SMM to copywriting, Content Development, you name it, I’ve done it. I’m extremely motivated, organized and disciplined – you have to be to work from home. My experience in Freelancing is invaluable- but what makes me a cut above the rest is my passion to deliver quality results to all my clients- it’s important to note, I've never had a dissatisfied client. Backed by a Masters degree in Computer Science from MOI university, I have the required skill set and burning passion and desire to deliver the best results for my clients. This is the reason why I am a cut above the rest. Having taken a Bsc. in computer science and statistics, I deal with all round fields in the IT category. It is a field i enjoy working in as it is dynamic and new things present themselves every day for research and exploration.

5.00+

1+ Reviews

10+ Question Solved

Related Book For

Income Tax Fundamentals 2021

ISBN: 9780357141366

39th Edition

Authors: Gerald E. Whittenburg, Martha Altus-Buller, Steven Gill

Question Posted:

Students also viewed these Business questions

-

Determine from the tax table in Appendix A the amount of the income tax for each of the following taxpayers for 2014: aapayer) Allen Filing Status Income Tax Taxable Income $21,000 24,54S 35,784...

-

Determine from the tax table in Appendix A the amount of the income tax for each of the following taxpayers for 2016: Taxpayer(s) Allen Filing Status Single MFS MFJ H of H Single Taxable Income...

-

Determine from the tax table in Appendix A the amount of the income tax for each of the following taxpayers for 2018: erls) Allen Boyd Caldwell ble Income Income Tax Filing Status $21,000 24,545...

-

In Problems 1158, perform the indicated operation, and write each expression in the standard form a + bi. 2 + i i

-

Given the following list of classes and relationships for the previous car insurance system, list the preconditions and the post conditions for the Add a new vehicle to an existing policy use case....

-

Give an example of an information item at each extreme level for the following information dimensions. Example of Information at Information Dimensions Very High Level Very Low Level Subjectivity 2 ?...

-

10. Using Table 6, what is your best guess about the current price of gold per ounce?

-

On January 1, 2014, Rusty, Inc. decides to invest in 10,000 shares of Horsepasture stock when the stock is selling for $ 15 per share. On July 15, 2014, Horsepasture declares a $ 0.50 per share cash...

-

are the most popular assets of life insurance companies. State and local bonds O Corporate debt securities and stocks O Mortgages and mortgage-backed securities O Treasury securities

-

A store buys 125 cases. Each case contains 15 packages. They take a 6-month simple interest loan at 2.3%. What will the monthly payment be?

-

For each of the following cases, indicate the filing status for the taxpayer(s) for 2020 using the following legend: ASingle BMarried filing a joint return CMarried filing separate returns DHead of...

-

Beverly and Ken Hair have been married for 3 years. Beverly works as an accountant at Cypress Corporation. Ken is a full-time student at Southwest Missouri State University (SMSU) and also works...

-

Assume the same information as BEG-14 except that the discount rate is 12% instead of 10%. In this case, how much can Dempsey expect to receive from the sale of these bonds? LO15

-

Medical Helicopters In a study of helicopter usage and patient survival, results were obtained from 47,637 patients transported by helicopter and 111,874 patients transported by ground (based on data...

-

On January 1, 20X1, Laketown Company (the user) leased a truck for a seven-year period under a FINANCE LEASE and agreed to pay an annual lease payment of $6,000 at the end of each year. The interest...

-

ces Shouldice Hospital in Canada is widely known for one thing-hernia repair! In fact, that is the only operation it performs, and it performs a great many of them. Over the past two decades this...

-

2. An Annual General Meeting (AGM) is a meeting conducted annually where the members of an organization gather to discuss and vote on key issues. Public companies hold annual general meetings for...

-

The 3 P's of Sustainability refers to: O The groups of people that environmental efforts effect. O People, Planet, Profit O Population, Productivity, Principled None of the Above. Question 21 2...

-

On August 31, 2017, the account balances of Pitre Equipment Repair were as follows: During September, the following transactions were completed: Sept. 1 Borrowed $10,000 from the bank and signed a...

-

The power company must generate 100 kW in order to supply an industrial load with 94 kW through a transmission line with 0.09 resistance. If the load power factor is 0.83 lagging, find the...

-

Linda and Richard are married and file a joint return for 2019. During the year, Linda, who works as an accountant for a national airline, used $2,100 worth of free passes for travel on the airline;...

-

How much of each of the following is taxable? a. Cheline, an actress, received a $6,400 gift bag for attending the Academy Awards Ceremony during 2019. b. Jon received a gold watch worth $660 for 25...

-

For each of the following independent cases, indicate the amount of gross income that must be included on the taxpayers 2019 income tax return. a. Malchia won a $4,000 humanitarian award. b. Rob won...

-

5. Which of the following is the cheapest for a borrower? a. 6.7% annual money market basis b. 6.7% semi-annual money market basis c. 6.7% annual bond basis d. 6.7% semi-annual bond basis.

-

Waterloo Industries pays 30 percent corporate income taxes, and its after-tax MARR is 24 percent. A project has a before-tax IRR of 26 percent. Should the project be approved? What would your...

-

Imagine you are an Investor in the Stock Market. Identify three companies in the Korean Stock Market (KOSPI) where you would like to invest. Explain your answer

Study smarter with the SolutionInn App