For each of the following cases, indicate the filing status for the taxpayer(s) for 2020 using the

Question:

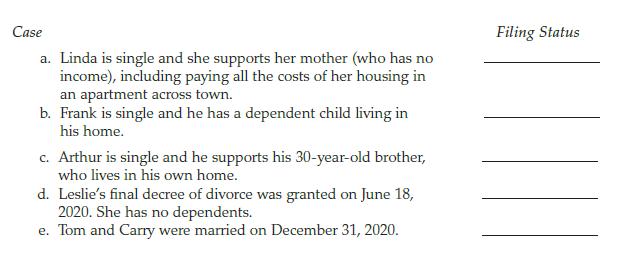

For each of the following cases, indicate the filing status for the taxpayer(s) for 2020 using the following legend:

A—Single

B—Married filing a joint return

C—Married filing separate returns

D—Head of household

E—Qualifying widow(er)

Transcribed Image Text:

Case a. Linda is single and she supports her mother (who has no income), including paying all the costs of her housing in an apartment across town. b. Frank is single and he has a dependent child living in his home. c. Arthur is single and he supports his 30-year-old brother, who lives in his own home. d. Leslie's final decree of divorce was granted on June 18, 2020. She has no dependents. e. Tom and Carry were married on December 31, 2020. Filing Status

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 100% (2 reviews)

a D ...View the full answer

Answered By

Muhammad Mahtab

everyone looks that their work be perfect. I have more than a five year experience as a lecture in reputable institution, national and international. I provide perfect solution in marketing, case study, finance problems, blog writing, article writing, business plans, strategic management, human resource, operation management, power point presentation and lot of clients need. Here is right mentor who help clients in their multi-disciplinary needs.

5.00+

3+ Reviews

14+ Question Solved

Related Book For

Income Tax Fundamentals 2021

ISBN: 9780357141366

39th Edition

Authors: Gerald E. Whittenburg, Martha Altus-Buller, Steven Gill

Question Posted:

Students also viewed these Business questions

-

For each of the following cases, indicate the filing status for the taxpayer(s) for 2012 using the following legend: A - Single B - Married, filing a joint return C - Married, filing separate returns...

-

Using the appropriate tax tables or tax rate schedules, determine the tax liability for tax year 2014 in each of the following instances. In each case, assume the taxpayer can take only the standard...

-

The following additional information is available for the Dr. Ivan and Irene Incisor family from Chapters 1-5. Ivan's grandfather died and left a portfolio of municipal bonds. In 2012, they pay Ivan...

-

In Problems 1158, perform the indicated operation, and write each expression in the standard form a + bi. 3i(-3 + 4i)

-

Develop a system sequence diagram based on the narrative and your activity diagram for problem 6 in this section.

-

Match the cost(s) most likely to be relevant to each listed decision. Decision Cost Accept a special order Internal unit-level manufacturing cost Close a plant Cost to buy externally Launch a new...

-

9. Consider Example 1. Suppose the February forward price had been \($2.80\). What would the arbitrage be? Suppose it had been \($2.65\). What would the arbitrage be? In each case, specify the...

-

Allen Abbott has a wide-curving, uphill driveway leading to his garage. When there is a heavy snow, Allen hires a local carpenter, who shovels snow on the side in the winter, to shovel his driveway....

-

Factor Company is planning to add a new product to its line. To manufacture this product, the company needs to buy a new machine at a $487,000 cost with an expected four-year life and a $19,000...

-

Chris and Stefani Watanabe live with their two boys at 1400 Victoria Lane, Riverside, CA 92501. Chris is an accountant who has his own accounting practice. Stefani is an elementary school teacher....

-

Which of the following taxpayers is not eligible for an economic impact payment in 2020? a. Savannah, a married taxpayer with no children, and has AGI of $75,000 in 2020 b. Blake, a single taxpayer...

-

Determine from the tax table in Appendix A the amount of the income tax for each of the following taxpayers for 2020: Taxpayer(s) Allen Boyd Caldwell Dell Evans Filing Status Single MFS MFJ H of H...

-

Refer to Problem 3.18. Determine the overconsolidation ratio for the clay. Use Eqs. (3.42) and (3.45). Use ' o = 64.2 kN/m 2 . Eqs. (3.42) Eqs. (3.45) Problem 3.18. a. A vane shear test was conducted...

-

Sample for a Poll There are 30,488,983 Californians aged 18 or older. If The Gallup organization randomly selects 1068 adults without replacement, are the selections independent or dependent? If the...

-

Part A: You have successfully graduated Conestoga College and have joined a public accounting firm in their tax department. You have been assigned to work on a project with Emily Wilson, one of the...

-

Write a program that gets a list of integers from input, and outputs negative integers in descending order (highest to lowest). Ex: If the input is: 10 -7 4-39 -6 12 -2 the output is: -2-6-7-39 For...

-

The manager of a division that produces add-on products for the automobile industry had just been presented the opportunity to invest in two independent projects. The first is an air conditioner for...

-

4. We are interested in the effect on test scores of the student-teacher ratio (STR). The following regression results have been obtained using the California data set. All the regressions used...

-

The financial statements of Corus Entertainment are presented in Appendix A at the end of this textbook. Instructions (a) What title does Corus use for its income statement? What title does Corus use...

-

Research corporate acquisitions using Web resources and then answer the following questions: Why do firms purchase other corporations? Do firms pay too much for the acquired corporation? Why do so...

-

Which of the following conditions need not be satisfied in order for a married taxpayer, residing in a community property state, to be taxed only on his or her separate salary? a. The husband and...

-

Indicate whether each of the items listed below would be included (I) in or excluded (E) from gross income for the 2019 tax year. a. Welfare payments b. Commissions c. Hobby income d. Scholarships...

-

Kristen, a single taxpayer, receives two 2019 Forms W-2 from the two employers she worked for during the year. One Form W-2 lists her wages in Boxes 1, 3, and 5 as $18,700. Her other employers Form...

-

En prenant un exemple de votre choix, montrer comment on value un swap de taux de change.

-

How much would you need to invest today in order to receive: a. $10,000 in 5 years at 11%? b. $11,000 in 12 years at 8%? c. $12,000 each year for 10 years at 8%? d. $12,000 at the beginning of each...

-

A company that manufactures pulse Doppler insertion flow meters uses the Straight Line method for book depreciation purposes. Newly acquired equipment has a first cost of $190,000 with a 3-year life...

Study smarter with the SolutionInn App