During the 2018 tax year, Brian, a single taxpayer, received $7,400 in Social Security benefits. His adjusted

Question:

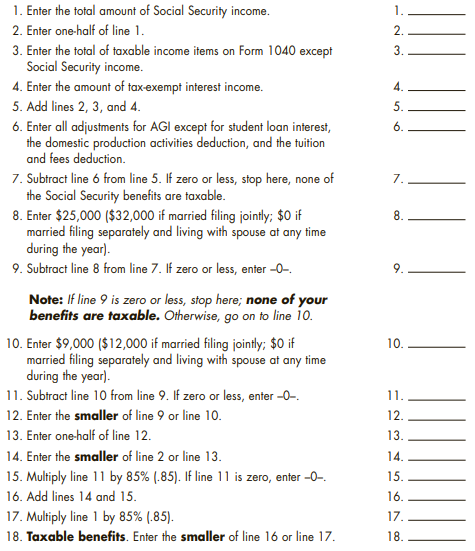

During the 2018 tax year, Brian, a single taxpayer, received $7,400 in Social Security benefits. His adjusted gross income for the year was $14,500 (not including the Social Security benefits) and he received $30,000 in tax-exempt interest income and has no for-AGI deductions. Calculate the amount of the Social Security benefits that Brian must include in his gross income for 2018.

Transcribed Image Text:

1. Enter the total amount of Social Security income. 1. 2. Enter one-half of line 1. 2. 3. Enter the total of taxable income items on Form 1040 except Social Security income. 4. Enter the amount of tax-exempt interest income. 3. 4. 5. Add lines 2, 3, and 4. 5. 6. Enter all adjustments for AGI except for student loan interest, the domestic production activities deduction, and the tuition and fees deduction. 6. 7. Subtract line 6 from line 5. If zero or less, stop here, none of the Social Security benefits are taxable. 8. Enter $25,000 ($32,000 if married filing jointly; $0 if married filing separately and living with spouse at any time during the year). 9. Subtract line 8 from line 7. If zero or less, enter -0-. 7. 8. Note: If line 9 is zero or less, stop here; none of your benefits are taxable. Otherwise, go on to line 10. 10. Enter $9,000 ($12,000 if married filing jointly; $0 if married filing separately and living with spouse at any time during the year). 11. Subtract line 10 from line 9. If zero or less, enter -0-. 10. 11. 12. Enter the smaller of line 9 or line 10. 12. 13. Enter one-half of line 12. 13. 14. Enter the smaller of line 2 or line 13. 14. 15. Multiply line 11 by 85% (.85). If line 11 is zero, enter -0-. 15. 16. 16. Add lines 14 and 15. 17. Multiply line 1 by 85% (.85). 17. 18. Taxable benefits. Enter the smaller of line 16 or line 17. 18.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 87% (16 reviews)

1 Enter the total amount of social security income 2 Enter onehalf of line 1 3 Enter the total of ta...View the full answer

Answered By

Omar ELmoursi

I'm Omar, I have Bachelor degree in Business and Finance, My unique approach is to help students with questions and assignments, I can teach Business, Math, Accounting, Managerial Accounting, Economy, Human resources management, organizational behavior, project management, I have experience dealing with different types of students and teach them how to deal with different types of exercises.

5.00+

4+ Reviews

10+ Question Solved

Related Book For

Income Tax Fundamentals 2019

ISBN: 9781337703062

37th Edition

Authors: Gerald E. Whittenburg, Steven Gill

Question Posted:

Students also viewed these Business questions

-

During the 2014 tax year, Brian, a single taxpayer, received $6,000 in Social Security benefits. His adjusted gross income for the year was $18,000 (not including the Social Security benefits) and he...

-

During the 2013 tax year, Brian, a single taxpayer, received $6,000 in Social Security benefits. His adjusted gross income for the year was $18,000 (not including the Social Security benefits) and he...

-

During the 2016 tax year, Brian, a single taxpayer, received $7,200 in Social Security benefits. His adjusted gross income for the year was $14,500 (not including the Social Security benefits) and he...

-

If Euros sell for $1.50 per euro, what should dollars sell for in Euros per dollar?

-

Switching to International Financial Reporting Standards (IFRS) will require companies to incur significant costs. What are the benefits of countries adopting IFRS?

-

The pair of triangles are similar. Find the missing length x and the missing angles A, B, and C. 10 -125 50 50 5. -B

-

What is yield management? What are the appropriate strategies for high- and low-demand periods?

-

Two different analytical tests can be used to determine the impurity level in steel alloys. Eight specimens are tested using both procedures, and the results are shown in the following tabulation. Is...

-

How long (in years) would $13,000 have to be invested at 10% compounded continuously to earn $6,393.72 interest

-

Hound Havens produces plastic doghouses as part of a continuous process through two departments: Molding and Finishing. Direct materials and conversion are added throughout the month in both...

-

Which of the following is not a test for the deductibility of a business expense? a. Ordinary and necessary test b. Expectation of profit test c. Reasonableness test d. Business purpose test

-

For 2018, the minimum percentage of Social Security benefits that could be included in a taxpayers gross income is: a. 0% b. 25% c. 50% d. 75% e. 85%

-

Solve each equation. 1 X 4 3x || 1 x - 2 X

-

Below are incomplete financial statements for Hurricane, Incorporated Required: Calculate the missing amounts. Complete this question by entering your answers in the tabs below. Income Statement Stmt...

-

TBTF Incorporated purchased equipment on May 1, 2021. The company depreciates its equipment using the double-declining balance method. Other information pertaining to the equipment purchased by TBTF...

-

Coco Ltd. manufactures milk and dark chocolate blocks. Below is the information relating to each type of chocolate. Milk Chocolate Selling price per unit $6 Variable cost per unit $3 Sales mix 4 Dark...

-

Data related to 2018 operations for Constaga Products, a manufacturer of sewing machines: Sales volume 5,000 units Sales price $300.00 per unit Variable production costs Direct materials 75.00 per...

-

6. (20 points) Sections 3.1-3.5, 3.7 Differentiate the following functions, state the regions where the functions are analytic. a. cos(e*) b. 1 ez +1 c. Log (z+1) (Hint: To find where it is analytic,...

-

Where can authoritative IFRS guidance related to intangible assets be found?

-

Prove the formula for (d/dx)(cos-1x) by the same method as for (d/dx)(sin-1x).

-

In which of the following ways are tax returns selected for most audits? a. Through the Discriminant Function System b. Through informants c. Through news sources d. Through information matching

-

Which of the following is not a penalty that may be imposed by the IRS? a. Failure-to-file penalty b. Failure-to-pay penalty c. Penalty for negligence d. Fraud penalty e. All of the above may be...

-

If a taxpayers 2016 individual income tax return was filed on March 3, 2017, the statute of limitations would normally run out on: a. April 15, 2019 b. March 3, 2016 c. April 15, 2020 d. March 3,...

-

Mediocre Company has sales of $120,000, fixed expenses of $24,000, and a net income of $12,000. If sales rose 10%, the new net income would be: Question 18 options: $16,800 $36,000 $13,200 $15,600

-

1. Why might managers of small restaurants decide not to adopt the standard work hour approach to controlling labour cost? (minimum 150 words )

-

Which statement is true regarding the U.S. GAAP impairment test for limited life intangibles? A. U.S. GAAP impairment is likely to be greater than IFRS impairment. B. The impairment test for limited...

Study smarter with the SolutionInn App