In June of 2018, Kevin inherits stock worth $125,000. During the year, he collects $5,600 in dividends

Question:

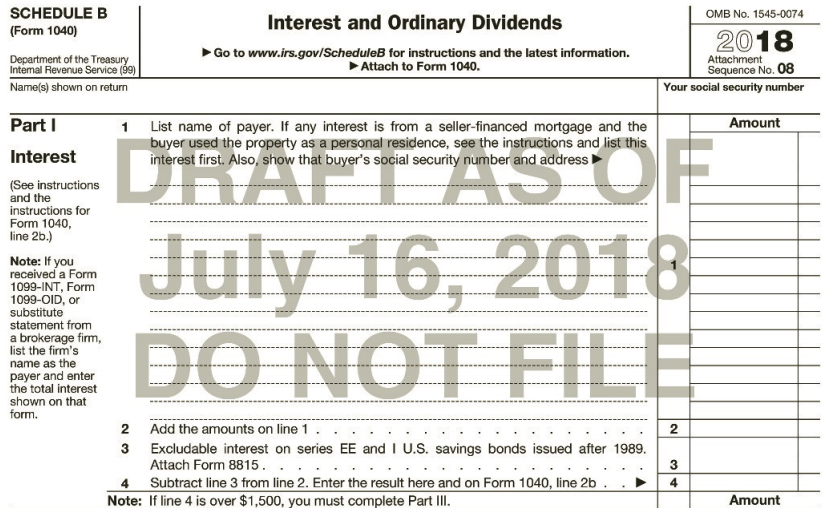

In June of 2018, Kevin inherits stock worth $125,000. During the year, he collects $5,600 in dividends from the stock. How much of these amounts, if any, should Kevin include in his gross income for 2018? Why? $

Transcribed Image Text:

SCHEDULE B OMB No. 1545-0074 Interest and Ordinary Dividends (Form 1040) 2018 Go to www.irs.gov/ScheduleB for instructions and the latest information. Attach to Form 1040. Department of the Treasury Intemal Revenue Service (99) Attachment Sequence No. 08 Your social security number Name(s) shown on return Amount 1 Part I List name of payer. If any interest is from a seller-financed mortgage and the buyer used the property as a personal residence, see the instructions and list this interest first. Also, show that buyer's social security number and addressI FOF e July 16, 2018 DO NOT FILE DRAT Interest (See instructions and the instructions for Form 1040, line 2b.) Note: If you received a Form 1099-INT, Form 1099-OID, or substitute statement from a brokerage firm, list the firm's name as the payer and enter the total interest shown on that form. 2 Add the amounts on line 1 3 Excludable interest on series EE and I U.S. savings bonds issued after 1989. Attach Form 8815. . . Subtract line 3 from line 2. Enter the result here and on Form 1040, line 2b 3 4 Note: If line 4 is over $1,500, you must complete Part III. Amount 2.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 60% (15 reviews)

5600 Inheritances are exc...View the full answer

Answered By

PALASH JHANWAR

I am a Chartered Accountant with AIR 45 in CA - IPCC. I am a Merit Holder ( B.Com ). The following is my educational details.

PLEASE ACCESS MY RESUME FROM THE FOLLOWING LINK: https://drive.google.com/file/d/1hYR1uch-ff6MRC_cDB07K6VqY9kQ3SFL/view?usp=sharing

3.80+

3+ Reviews

10+ Question Solved

Related Book For

Income Tax Fundamentals 2019

ISBN: 9781337703062

37th Edition

Authors: Gerald E. Whittenburg, Steven Gill

Question Posted:

Students also viewed these Business questions

-

In June of 2016, Kevin inherits stock worth $125,000. During the year, he collects $6,500 in dividends from the stock. How much of these amounts, if any, should Kevin include in his gross income for...

-

A. Ray and Maria Gomez have been married for 3 years. Ray is a propane salesman for Palm Oil Corporation and Maria works as a city clerk for the City of McAllen. Rays birthdate is February 21, 1990...

-

You are given the following post-closing trial balance for the Special Assessment Capital Projects Fund of the city of Stone Creek Bank as of January 1, 2018. The project was started last year and...

-

Horizon BP in Antelope Park, Alaska, has noticed that utility bills are substantially higher when the average monthly temperature is colder. The only thing in the shop that uses natural gas is the...

-

On each December 31, you plan to transfer $2,000 from your checking account into a savings account. The savings account will earn 9 percent annual interest, which will be added to the savings account...

-

Does the old saying You get what you pay for apply to a board of directors or a board of advisors?

-

Many monetary theorists see the money supply curve as vertical. Explain why a vertical money supply curve makes sense.

-

Suppose that a mathematical model fits linear programming except for the restrictions that 1. At least one of the following two inequalities holds: 2. At least two of the following three inequalities...

-

QUESTION B ONLY A COMPREHENSIVE ACCOUNTING CYCLE PROBLEM On December 1,2009, John and Patty Driver formed a corporation called Susquehanna Equip ment Rentals. The new corporation was able to begin...

-

Read the given description of a CSP and write solution as per the given questions: [20] YCPS@GIFT is going to arrange a gaming competition at campus. They are considering using seven games for this...

-

Ivanka and Jared are divorced in the current year. As part of the divorce settlement, Ivanka transfers a plot of land in Long Island, NY to Jared. Ivankas basis in the property was $20,000 and the...

-

Arlen is required by his 2018 divorce agreement to pay alimony of $2,000 a month and child support of $2,000 a month to his ex-wife Jane. What is the tax treatment of these two payments for Arlen?...

-

What is the output of the following application? A. 7 B. 5 C. The code does not compile. D. The code compiles without issue, but the output cannot be determined until runtime. E. None of the above....

-

Explain the memory layout of a C program and discuss how different segments of memory are managed. ?

-

Explain the "volatile" keyword in C. Where and why would you use it?

-

What is the difference between malloc() and Calloc() ?

-

GATE-2024(Electrical Engineering) question. Q.10 A surveyor has to measure the horizontal distance from her position to a distant reference point C. Using her position as the center, a 200 m...

-

Indicate how each of the following accounts should be classified in the stockholders equity section. (a) Common Stock (b) Retained Earnings (c) Paid-in Capital in Excess of ParCommon Stock (d)...

-

Write an SQL statement to display all data on products having a QuantityOnHand greater than 0.

-

Jason and Mary Wells, friends of yours, were married on December 30, 2016. They know you are studying taxes and have sent you an e-mail with a question concerning their filing status. Jason and Mary...

-

Indicate whether each of the items listed below would be included (I) in or excluded (E) from gross income for the 2016 tax year. __________ a. Welfare payments __________ b. Commissions __________...

-

How much of each of the following is taxable? a. Cheline, an actress, received a $10,000 gift bag from the Oscars during 2016. b. Jon received a gold watch worth $660 for 25 years of service to his...

-

why should Undertake research to review reasons for previous profit or loss?

-

A pension fund's liabilities has a PV01 of $200 million. The plan has $100 billion of assets with a weighted average modified duration of 8. The highest duration bond that the plan can invest in has...

-

Metlock Limited has signed a lease agreement with Lantus Corp. to lease equipment with an expected lifespan of eight years, no estimated salvage value, and a cost to Lantus, the lessor of $170,000....

Study smarter with the SolutionInn App