Laura is a single taxpayer living in New Jersey with adjusted gross income for the 2018 tax

Question:

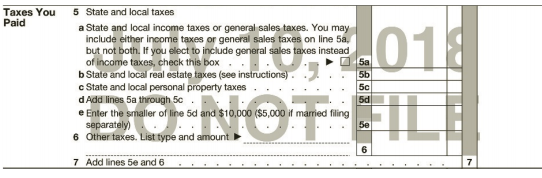

Laura is a single taxpayer living in New Jersey with adjusted gross income for the 2018 tax year of $35,550. Laura’s employer withheld $3,300 in state income tax from her salary. In April of 2018, she pays $600 in additional state taxes for her prior year’s tax return. The real estate taxes on her home are $1,750 for 2018, and her personal property taxes, based on the value of the property, amount to $375. Also, she paid $75 for state gasoline taxes for the year. Complete the taxes section of Schedule A below to report Laura’s 2018 deduction for taxes assuming she chooses to deduct state and local income taxes.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Income Tax Fundamentals 2019

ISBN: 9781337703062

37th Edition

Authors: Gerald E. Whittenburg, Steven Gill

Question Posted: