Basic Oil Company incurred intangible costs during 20XA related to the following: a. Assuming Basic is an

Question:

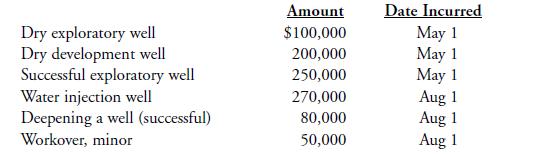

Basic Oil Company incurred intangible costs during 20XA related to the following:

a. Assuming Basic is an independent producer, how much IDC can it deduct for 20XA?

b. How much IDC could Basic deduct as an integrated producer?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Fundamentals Of Oil And Gas Accounting

ISBN: 9780878147939

4th Edition

Authors: Rebecca A. Gallun, Ph.D. Wright, Charlotte J, Linda M. Nichols, John W. Stevenson

Question Posted: