The following transactions for Nielsen Architects occurred during December of the current year. Follow the step-by-step instructions

Question:

Step 1: Start Integrated Accounting 8e.

Step 2: Open file IA8 Problem 08-A.

Step 3: Enter your name in the Your Name text box.

Step 4: Use Save As to save your file with a file name of 08-ABC Your Name (where 08-A identifies the problem, and BC represents Before Closing).

Step 5: Enter the following journal transactions directly into the General Journal tab.

Dec. 02

Purchased supplies on account from Lerner Supply Company, $315.00; Vendor Invoice No. 576.

03

Received cash on account from Foley Associates, Inc., covering Invoice No. 930 for $5,554.00.

04

Billed Rock more Construction for consulting services, $4,025.00; Invoice No. 951.

06

Paid cash for electric bill, $136.13. Check No. 810.

08

Reimbursed a partner for business travel expense, $158.00. Check No. 811.

Debit Travel Expense and credit Cash.

10

Paid cash on account to Riverview Media, Inc., $902.00. Check No. 812.

10

Billed Foley Associates, Inc. for consulting services, $3,250.00; Invoice No. 952.

12

Purchased supplies on account from Stolle Office Products, $148.50; Vendor Invoice No. 577.

16

Paid cash for advertising, $735.00. Check No. 813.

18

Paid cash on account to Stolle Office Products, $456.00. Check No. 814.

18

Billed Security Engineering Co. for consulting services, $4,800.00; Invoice No. 953.

18

Received cash on account from Security Engineering Co., covering Invoice No. 935 for $7,996.00.

20

Paid cash for telephone bill, $497.57. Check No. 815.

21

Purchased office equipment on account from Parker Office Products, $500.00; Vendor Invoice No. 578.

22

Reimbursed a partner for travel expenses, $315.00. Check No. 816.

23

Daniel Nielsen, a partner, withdrew cash for personal use, $2,450.00. Check No. 817.

23

Kari Nielsen, a partner, withdrew cash for personal use, $2,450.00. Check No. 818.

23

Glenn Weldon, a partner, withdrew cash for personal use, $2,100.00. Check No. 819.

28

Paid cash for miscellaneous expense, $65.00. Check No. 820.

28

Billed Randall Development Co. for consulting services, $2,500.00; Invoice No. 954.

30

Paid salaries expense, $1,810.62. Check No. 821.

31

Paid cash for rent expense, $935.00. Check No. 822.

Step 6: Display the journal entries and make corrections, if necessary.

Step 7: Display the trial balance.

Step 8: Display the schedule of accounts payable.

Step 9: Display the schedule of accounts receivable.

End-of-Month Activities

Use the following adjustment data for the month of December for Nielsen Architects and the trial balance report as the basis for preparing the adjusting entries.

Inventory of supplies on December 31..........................$2,105.00

Insurance expired during December................................ $110.00

Depreciation on office equipment for December .......... $228.74

Step 1: Enter the adjusting entries in the general journal. Enter a reference of Adj.Ent. in the Reference text box.

Step 2: Display the adjusting entries.

Step 3: Display the income statement.

Step 4: Display the balance sheet.

Step 5: Generate an income statement graph.

Step 6: Save your data to disk with file name 08-ABC Your Name.

Step 7: Optional spreadsheet integration activity.

The partners at Nielsen Architects asked you to use a spreadsheet to prepare a distribution of net income statement for the current year. For the partially constructed spreadsheet template file, you must complete the following steps:

a. Display and copy the income statement to the clipboard in spreadsheet format.

b. Start your spreadsheet software and load template file IA8 Spreadsheet 08-A.

c. Select cell A1 as the current cell (if not already selected) and paste the income statement into the spreadsheet.

d. Enter the formulas appropriate for your spreadsheet software to calculate the distribution of net income (or loss) for each partner for the year. Also enter the formula to obtain a sum of the partner€™s distribution.

Daniel Nielsen = 35 percent

Kari Nielsen = 35 percent

Glenn Weldon = 30 percent

e. Format the amounts in currency format if necessary.

f. Print the spreadsheet distribution of net income statement.

g. Save your spreadsheet with a file name of 08-A Your Name.

h. What if the distribution of net income were changed as follows:

Daniel Nielsen = 38 percent

Kari Nielsen = 38 percent

Glenn Weldon = 24 percent

Change the distribution of net income statement to reflect these partnership percentages. Do not save this data.

i. Exit your spreadsheet session and return to the Integrated Accounting 8e application.

Step 8: Optional word processing integration activity.

Prepare a memo addressed to each partner of Nielsen Architects, showing their distribution of net income for the year ended December 31.

a. Start your word processing software application and create a new document.

b. Enter a memorandum to Daniel Nielsen, Kari Nielsen, and Glenn Weldon. If you completed the optional spreadsheet activity in Step 7, copy and paste the distribution of net income from your spreadsheet into your document.

c. Print the memorandum.

d. Save the memorandum with a file name of 08-A Your Name.

e. End your word processing session.

Step 9: Generate and post the closing journal entries.

Step 10: Display the computer-generated closing entries.

Step 11: Display a trial balance.

Step 12: Enter the journal entries to close the partners€™ Drawing accounts to their Capital accounts. Also enter the journal entry to close the Income Summary account to the partners€™ Capital accounts based on the method of income distribution: 35 percent to Daniel Nielsen, 35 percent to Kari Nielsen, and 30 percent to Glenn Weldon. Enter a reference of Clo.Ent. in the Reference text box.

Step 13: Display all the closing entries.

Step 14: Display a post-closing trial balance.

Step 15: Use Save As to save your data with a file name of 08-AAC (where 08-A identifies the problem, and AC represents After Closing).

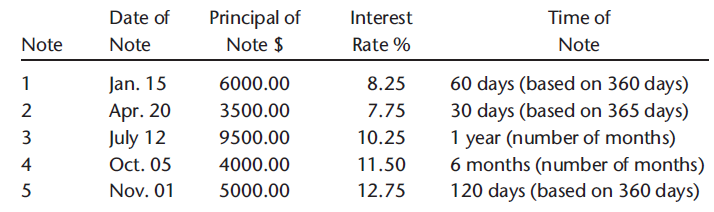

Step 16: Calculate maturity dates, interest, and value on notes.

Use the Notes & Interest Planner to calculate the maturity date, interest, and maturity value for each of the following notes. Use the current year for the date of each note.

Step 17: End the Integrated Accounting 8e session.

DistributionThe word "distribution" has several meanings in the financial world, most of them pertaining to the payment of assets from a fund, account, or individual security to an investor or beneficiary. Retirement account distributions are among the most... Maturity

Maturity is the date on which the life of a transaction or financial instrument ends, after which it must either be renewed, or it will cease to exist. The term is commonly used for deposits, foreign exchange spot, and forward transactions, interest... Partnership

A legal form of business operation between two or more individuals who share management and profits. A Written agreement between two or more individuals who join as partners to form and carry on a for-profit business. Among other things, it states...

Step by Step Answer:

Integrated Accounting

ISBN: 978-1285462721

8th edition

Authors: Dale A. Klooster, Warren Allen, Glenn Owen