The Norwood Lease has the following working interest owners: Shamrock Company 50%, Diamond Company 25%, and Heart

Question:

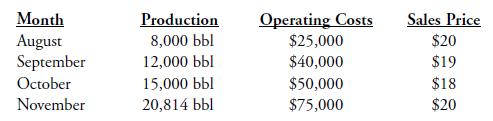

The Norwood Lease has the following working interest owners: Shamrock Company 50%, Diamond Company 25%, and Heart Company 25%. There is a 1/8 royalty on the lease. On April 1, 2001, Shamrock Company, the operator, receives notice that Diamond Company is going non-consent on the drilling of the Gusher No. 2. Shamrock Company and Heart Company agree to carry Diamond’s share proportionately. The non-consent penalty is 300%. On August 1, the Gusher No. 2, which was drilled and completed at a cost of \($250,000,\) goes on production. The production and operating information for the next few months is as follows:

REQUIRED: Assuming severance tax is ignored:

a. Determine Shamrock Company and Heart Company’s proportionate share of drilling and equipping costs.

b. Prepare a table determining when Diamond Company will payout.

c. Prepare the journal entry that Shamrock Company will make during August to book its share of production revenue.

Step by Step Answer:

Fundamentals Of Oil And Gas Accounting

ISBN: 9780878147939

4th Edition

Authors: Rebecca A. Gallun, Ph.D. Wright, Charlotte J, Linda M. Nichols, John W. Stevenson